IMF call for carbon tax on aviation, shipping would spur innovation

By Joe Robertson

Now that 195 nations have agreed to collaborate for comprehensive global climate action, the International Monetary Fund has published a report calling for a carbon tax on shipping and aviation. The argument is very simple: these emissions cause widespread economic distortion and are a hidden drag on the build-up of new economic value; correcting for that error gives us a more efficient economy and a healthier future.

For a long time, we have listened to advocates against any and all taxation talk about the “destruction” of economic value by imposing unnecessary costs on business and investment activity. What they are referring to is the question of market distortion, which hampers overall economic efficiency, and equates to opportunity cost — the loss of otherwise likely economic activity and new value creation. For some businesses, specific economic distortions add to the cost of doing business; for others, the distortion tilts the landscape of economic activity or direct investment in their favor.

Subsidies can create market distortions, unless they are very carefully designed to make an already biased economy behave more fairly. In general, investors and businesses that receive direct assistance through subsidies, tax credits, or loan guarantees, feel enriched and empowered by them. Because they experience personal or sectoral gain, they tend not to talk about those distortions as “destruction”.

Economic assistance that allows for the inexpensive expansion of climate-forcing greenhouse gas emissions not only distorts energy markets; it adds cost to the entire economy, as carbon fuel business costs are externalized onto all other economic actors. When fossil fuels appear inexpensive, it is because upfront, operational and long-term costs are being externalized from the businesses in question to the rest of us.

Revenues to drive innovation

What the IMF Staff Discussion Note is calling for is an easy starting price, which would raise revenues that could be used to drive innovation, efficiency and change, where the market is failing to do so. The argument is: this would be a better, more efficient use of resources than the current standard, where costly practices, supported by more than $5 trillion in annual assistance, add cost and harm to the rest of human activity.

The airline and shipping industries have a unique vulnerability, related to their use of carbon-emitting fuels. They are less agile in their ability to transition to low-carbon alternatives, which means they will suffer a greater sector-wide impact from the decline of these fuels over time. Given the stronger tie to an increasingly obsolete way of doing business, they need to put resources into research they cannot conduct on their own and for which no one is rewarding them right now.

The reasons for an agreement to tax shipping and aviation include other considerations as well. For instance, the jurisdictional complication inherent in both: Which nation should charge the tax, the point of departure, the point of arrival, or the home-base of the vessel in transit?

There are also uniquely complicated national relationships to each industry. Panamá, for instance, benefits from traffic through the Panamá Canal, but has made an agreement not to impose a levy on fuel for vessels transiting the Canal. The shipping emissions footprint for this one small nation could be seen as massive, but it cannot make the correction on these externalities on its own.

Connection between shipping and trade

Many nations share responsibility for the carbon intensity of this national industry. The connection between shipping and trade makes some version of this complication part of the policy picture almost everywhere. For smaller economies, a global carbon tax agreement on shipping means a more level playing field, and a way to ensure cost correction plays out across a wider range of economic activity.

With respect to aviation, the European Union has sought to impose added fees on air traffic from the United States, using border adjustments, but without policy collaboration from the US, this approach could mean too high a burden of opportunity cost on the European tourism and business travel sectors. A shared global policy would make reaching agreement on such approaches easier, and speed the transition to enhanced carbon efficiency in air travel.

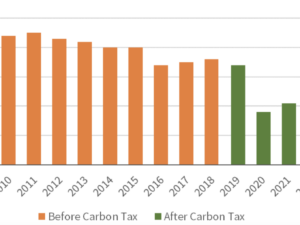

With aviation emissions set to double or triple by mid-century, action is needed to reduce the sector’s impact on overall climate action efficiency. Revenues from the tax suggested by IMF staff would go to financing research, technology transfer, and efficiency enhancements, to reduce emissions, and pare down overall climate impact costs globally.

The U.S. military is already deploying hybrid-drive battleships, to reduce fuel costs and vulnerability to the wild fluctuation in price for future fuel. Some in the aviation sector are working to reduce net carbon emissions to near zero, through technological cooperation and rapid innovation. A carbon price applied to shipping and aviation would steer investment into these innovations, reducing overall cost to pioneers and standardizing the more efficient practices sooner rather than later.

Joe Robertson is a member of CCL’s Blog Team and Global Strategy Director for CCL.