Carbon taxes vs. regulation: More effective, efficient & fair

By Jerry Hinkle, CCL Economics Policy Network

Carbon taxes are garnering more research, in part due to CCL’s efforts, and they are being compared to regulations as a method for reducing carbon emissions. This work confirms that for most sources of greenhouse gases (GHGs), a moderate carbon fee can reduce emissions as much as regulations, can do so at far less cost, and can ensure the poor are made better off for it. CCL is clear that there is a productive role for regulation in comprehensive climate policy, as a carbon price on fossil fuels will not impact all sources of GHG emissions. However, for the vast majority of U.S. emissions, a carbon tax is a more effective, efficient, and fair way to reduce carbon pollution.

Effective

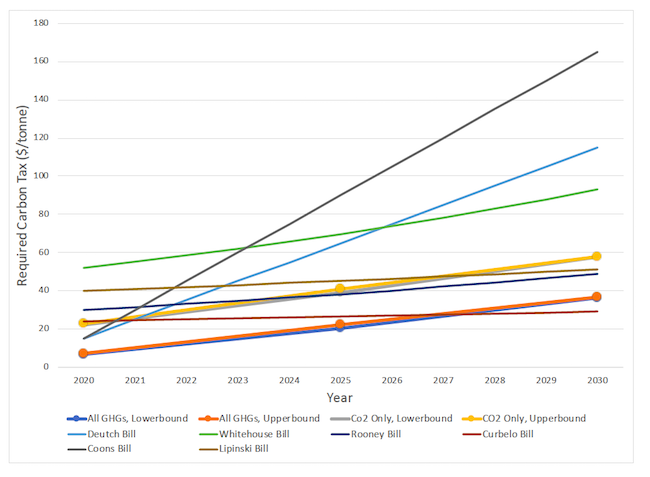

The 2018 EMF 32 study of 11 top peer-reviewed models made clear that a carbon tax would be effective at reducing U.S. emissions. How effective, exactly? A recent working paper from an MIT researcher rather provocatively points out that even moderate carbon taxes on GHGs would be able to achieve the same emissions reductions as the Clean Power Plan (CPP), Corporate Average Fuel Economy (CAFE) standards, and Renewable Fuel Standards (RFS) combined. Specifically, if the tax is applied to all GHGs, a carbon price per metric ton of only $7 in 2020, $22 in 2025, and $36 in 2030 is estimated to generate the same emissions reductions as the regulations. The graph below shows that generally all of the current carbon pricing bills meet this standard, and so would generate more reductions than these regulations.

Graph: Carbon Taxes Required to Replace the CAFE, CPP,

and RFS Compared to the Current Congressional Bills

Efficient

And, importantly, it would achieve these same reductions at a far lower cost. As discussed by the EPA, market mechanisms reduce emissions at less cost than regulations. For example, this study found that the RFS reduces emissions at three times the cost of a pollution pricing approach, and Mark Jacobsen found that CAFE standards cost six times more than a gas tax to reduce emissions (see page 35 of the reference). We believe an efficient policy that reduces emissions at less cost will, over the long run, be more popular with the voting public and thus be more stable.

Fair

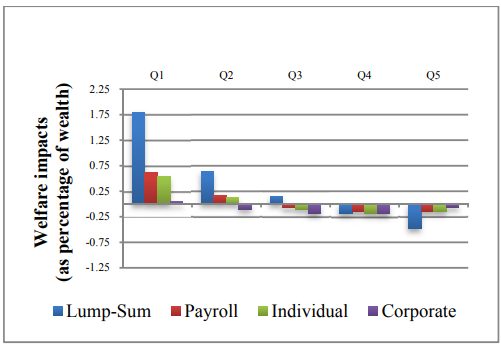

It is important to CCL that the poor not assume an undue burden from the climate policy. The Household Impact Study shows that the poorest generally receive a financial benefit from our carbon fee and dividend (CF&D) policy. The most recent research indicates that, though CF&D (blue bar) is the most progressive (relatively beneficial to the poor), a policy in which funds are used to reduce payroll (red) or income (green) taxes would provide a small net benefit to them as well.

In contrast, according to the working paper referenced above, the three current regulations are less beneficial to the poor than carbon tax policies, and this research, as well as that from Jacobsen (above) shows that CAFE standards are actually mildly regressive, hurting the poor. In sum, reducing emissions through a carbon tax, as opposed to regulations, is better for the poor financially.

In summary, CCL is clear that there is a productive role for regulation in comprehensive climate policy as a carbon price on fossil fuels will not impact all sources of emissions. However, for the majority of U.S. emissions, a carbon tax is a more effective, efficient, and fair way to reduce those emissions. And carbon fee and dividend is “fairest of them all”!

Jerry Hinkle is an economist who holds master’s degrees in Economics and Climate Policy.

The Economics Policy Network is a team of CCL leaders and supporters with a diverse background in the field of economics. These network contributors write regular guest posts, offering thorough insight into topics that fall within their expertise. Their resources are available in the form of white papers on CCL Community.