Why we still need a national carbon fee

By Jonathan Marshall

The historic Inflation Reduction Act (IRA), which delivers nearly $400 billion in climate investment over a decade, is easily the most powerful climate policy ever enacted in the United States. Coming on top of significant climate-related provisions in the Infrastructure Investment and Jobs and the CHIPS and Science Act, America is finally taking the global crisis seriously.

But most climate experts probably agree with CCL Executive Director Madeleine Para, who said, “We’re eager to build on today’s big step forward and continue to work for even more, and even better, climate action in the future.”

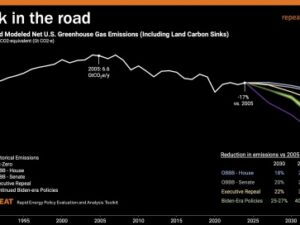

The reason should be obvious. Although this bold climate legislation should help bring U.S. greenhouse gas emissions down about 40 percent by 2030, that’s still well short of our national commitment of a 50 percent reduction. If we want to have any hope of keeping global warming under 2°C, the U.S. (and other countries) will need to get all the way to net zero by 2050 — a far bigger lift.

Just spending more money to subsidize renewable energy, electric vehicles, and other clean technologies won’t do the job, for several reasons:

- Simple budget math works against us. As the size of the clean sector grows, the cost of subsidies will grow in tandem, dwarfing the huge numbers seen to date. Finding that money without major tax increases or ballooning the national debt will be a mathematical impossibility.

- The law of diminishing returns also works against us. Subsidized renewable energy will indeed drive out more expensive fossil fuels, like Canadian tar sands and much coal, but only up to a point. There are plenty of cheap oil and gas reserves still around, and the huge installed base of industrial infrastructure dependent on fossil fuels could remain economically viable for years to come.

- Cost-effectiveness is also an issue: subsidies are often wasted on people who would have bought electric vehicles or invested in wind farms even without them. They are not a very effective way to allocate investment because the money does not necessarily flow to the most efficient businesses. Worse yet, they can create political coalitions that demand subsidies in perpetuity, long after they are economically justified.

Going forward we’ll need new approaches, above all a national tax or fee on greenhouse gas pollution. A technology-neutral carbon fee would work with clean energy subsidies and regulations to rapidly accelerate the phase-out of fossil fuel emissions. A carbon fee could take effect quickly and cover most sectors of the economy in one fell swoop. Instead of costing the government billions of dollars, it would raise revenue that can be used to soften impacts on households, invest in green programs, or reduce the deficit. These are just a few of the reasons why more than 3,600 economists declared, “A carbon tax offers the most cost-effective lever to reduce carbon emissions at the scale and speed that is necessary.”

How subsidies could pave the way for carbon fees

Although Congress missed (by as little as one vote in the Senate) the opportunity to include a carbon fee in the reconciliation package, the IRA’s climate provisions may well pave the way for carbon pricing in the not-too-distant future. That’s the logical conclusion one can draw from policy experts who argue that the best way to build public support for a carbon fee is through “policy sequencing”: starting with the carrots before getting to the sticks.

In 2015, Environmental Defense Fund’s lead economist Gernot Wagner praised carbon pricing in the prestigious journal Nature but deplored its limited adoption. He called for well-conceived subsidies akin to those in the IRA to create the right political environment.

“The current inadequacy of carbon pricing stems from a catch-22,” he wrote. “Policymakers are more likely to price carbon appropriately if it is cheaper to move onto a low-carbon path. But reducing the cost of renewable energies requires investment, and thus a carbon price. In our view, the best hope of ending this logjam rests with tuning policies to drive down the cost of renewable power sources even further and faster than in the past five years.”

Two years later, Wagner and two other scholars reviewed the successful history of carbon pricing in the European Union and California in Nature Energy and observed that “policymakers initially supplied benefits to clean-energy constituencies before imposing costs on polluters.” They concluded that “lower mitigation costs may reduce the opposition to carbon policy.”

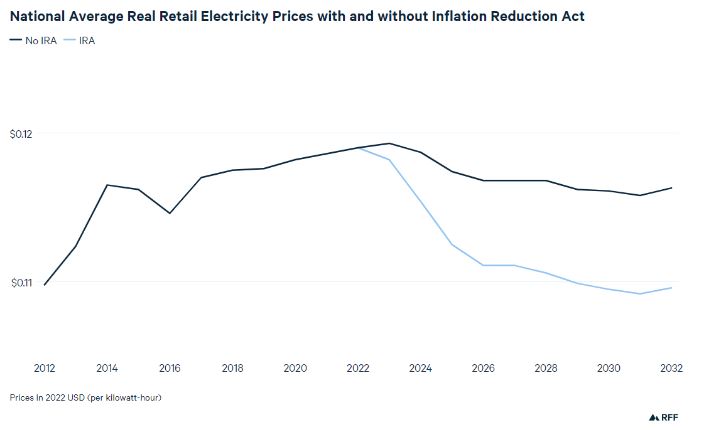

Past subsidies for wind and solar energy and batteries indeed created huge economies of scale in production along with leaps in technology, putting these clean technologies in reach of consumers with little or no financial sacrifice. The IRA promises to extend the popular honeymoon with clean technologies. At a time when households are straining to cope with soaring fossil fuel prices, Resources for the Future estimates that retail costs of electricity will decline about six percent over the next decade, “saving electricity consumers $209-278 billion.” That’s about $200 a year per household.

Carbon taxes supercharge the effect of subsidies

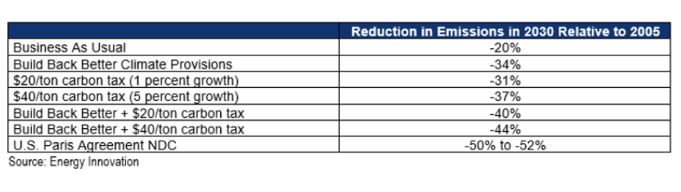

The other good news is that a carbon tax would supercharge the effect of the IRA’s subsidies, accelerating shifts in consumer demand and business production methods to favor low-carbon goods and services. We already have evidence of this proposition from several forecasts related to the full Build Back Better (BBB) bill.

Using Energy Innovation’s model, the Committee for a Responsible Federal Budget concluded earlier this year that the addition of a $40 carbon tax would slash emissions an additional 10 percentage points beyond the IRA’s precursor policy (Build Back Better), putting us much closer to our Paris commitment. The fiscally conservative organization also applauded the fact that such a carbon tax would raise $1,550 billion in new revenue over 10 years, rather than adding to the national debt.

Source: Committee for a Responsible Federal Government

Confirming this general story with a different model, Resources for the Future reported last year that a rising carbon tax, reaching $50 per ton by 2030, would cut emissions more than 13 percentage points beyond the impacts of IRA-type subsidies for renewable energy, clean vehicles and the like. Such cuts would readily meet the Paris target.

In the electric power sector, RFF projected that an all-subsidy approach would cut cumulative emissions of CO2 by 3.8 billion metric tons from 2022 to 2031. A modest carbon fee, on its own, would cut cumulative emissions by 5.5 billion metric tons. The two together, however, achieved cumulative reductions of 7.2 billion tons — a big win for decarbonization.

Going forward, Congress should heed the Rhodium Group’s informed observation last year about what policies could take the United States closer to the net-zero goal after the enactment of clean energy subsidies:

“A carbon price, applied to key sectors or across the entire economy, has been seen as the most efficient and straight-forward way to tackle climate change. A carbon price can amplify the impact of clean energy incentives included in our joint action scenario and sends a long-term signal for investors to shift towards a net-zero economy.”

Or as the World Resources Institute declared last year, “We need all measures — everything in the [infrastructure bill], everything in the reconciliation package and carbon pricing. We can’t accept anything less than enough.”

Learn about the Inflation Reduction Act here

Jonathan Marshall, the Economics Research Coordinator for Citizens’ Climate Education, is former Economics Editor of the San Francisco Chronicle and the author of six books.