International Energy Agency director says it’s time to price carbon

Joe Robertson

Oil prices have come down dramatically in the last few months, causing speculation that we are about to see a boom in oil consumption, and a move away from fuel-efficient vehicles, hybrid engines, alternative fuels, and electric cars. Maria van der Hoeven, executive director of the International Energy Agency, sees it differently: this is an opportunity to put in place the policies that will allow us to avoid future negative fallout from over-dependence on fossil fuels.

Speaking recently at the Oxford Energy Colloquium, van der Hoeven said:

IEA Director Maria van der Hoeven with CCL’s Joe Robertson at the COP20 climate change meeting in Peru last December.

“If the world seeks to truly encourage more efficient use of energy, boost the economic case for carbon capture and storage, and promote low-carbon energy sources including renewables and nuclear power, then there must be an effective, realistic price on carbon.

“Low oil prices provide an opportunity here. Policy makers in major energy consuming countries can take advantage of the oil market’s collapse to introduce carbon pricing, taxes, or low-carbon mandates, or to strengthen existing schemes…

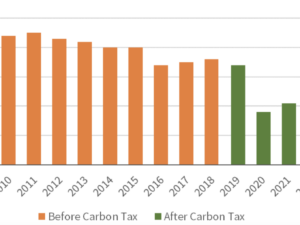

“Critics argue that carbon taxes are job killers, but this is again short-sighted. If such schemes are designed properly, and put in place in an environment of lower energy prices, economic discomfort can be minimized. Indeed, many studies suggest that they can yield a net economic benefit.”

The macroeconomic law of Supply and Demand does a lot to determine what direction a given market will take, but it does not mean consumers are handily in charge of all market dynamics. In fact, without a clear signal to the marketplace, the complexities of oil market dynamics mean sudden changes in pricing, or counterintuitive long-term trends, will lead to haphazard decision-making, irresponsible risk-taking, and whiplash responses — over-reacting to apparent indicators of market-direction, which then leave a given economic interest lagging, when the indicator reverses course again.

A recent surge in oil prices, which rose more than 10% in one day, shows the risks inherent in depending on a highly volatile market for combustible fuels. While prices sometimes dip low enough to make every budgetary dollar go twice as far, in that one area, the possibility of a sudden surge in prices always means those extra dollars can’t easily be spent or invested in other things. The low prices don’t necessarily add value elsewhere.

Many believe a moment of low prices for fossil fuels means the time is right for a major expansion of fossil fuel investment. But global demand for coal and oil is declining, relative to overall consumption, while the cost of production in renewables is falling at record pace. Pouring more money into drilling sets up investors, and more importantly, the wider economic landscape, for a whiplash effect, as the hidden costs of doing so start to eat away at future returns. We lose a lot of value to whiplash, and a lot of time.

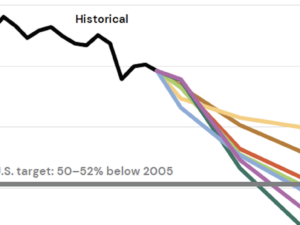

According to van der Hoeven, “With its heavy reliance on fossil fuels, the current system is on course to deliver at least a 4-degree Celsius increase in global temperatures if no changes are made.” We know that the costs associated with climate disruption have been increasing exponentially, and we are only at 0.8ºC increase so far. There is real evidence that beyond a 2ºC increase, a significant portion of all public spending will have to be committed to climate impact response of one kind or another.

Van der Hoeven wisely observed that “the risk is that lower oil prices will introduce policy uncertainty. This is once again why policy makers must be smart, patient, and prudent, and at the same time industry should take advantage of an opportunity. This is not the moment for either policy makers or industry to lose sight of the big picture.” The last thing we want to do is needlessly build in high future costs, because our vision is too short-sighted.

The true meaning of the moment is that this is the perfect time to make policy adjustments that some big market players will see as disruptive. Added consumer costs can slow progress, depending on how a policy is introduced and phased in, so with prices low, now is the time to act, with minimal risk of economic drag and maximum possibility of policy return on investment.

Van der Hoeven notes there are specific “opportunities” inherent in this unique market moment. Among those, she cites “elimination of subsidies to fossil fuel consumption.” The IEA looks at the value of subsidies that result in a lowering of the consumer price for fossil fuels, and finds these subsidies are adding cost to the marketplace, not reducing it. They are, in a sense, a kind of wasteful spending. Subsidies of this kind to fossil fuels were five times those going to renewables, globally, in 2013, equal to twice the total world investment in renewables in 2014.

She also called for “an effective, realistic price on carbon”. This can be done through low-carbon energy requirements (renewable portfolio standards, for instance), licensed emissions trading (LET, ETS or Cap and Trade), or through the more efficient direct application of carbon fees. A steadily rising carbon fee adds a clear price signal to the mix of market dynamics.

Send a clear market signal, and investors, suppliers, and manufacturers, will receive it; they will provide low-carbon options to consumers, and consumers will adjust, without pain, to a market that changes around them and provides better and more sustainable value.

There are three major policy levers for addressing climate disruption: climate impact response (which includes spending on disaster relief, adaptation, and resilience), low-carbon technology deployment, and carbon pricing. Our Pathway to Paris whitepaper details why pricing carbon efficiently, transparently, and effectively, builds future value most directly into the current economy. Ms. van der Hoeven’s speech to the Oxford Energy Colloquium, on January 27, says it plainly: now is the time to add policies with clear definition about future direction to our energy markets: eliminate subsidies, price carbon, motivate investment.

We should seize the moment to build a smarter energy economy and secure more robust and resilient future returns.