CCL staffers Dana Nuccitelli and Elissa Tennant

Episode 104: Saving Clean Energy Tax Credits: Inside the Inflation Reduction Act Fight

Episode Summary:

In this episode of Citizens’ Climate Radio, we dive into the Inflation Reduction Act (IRA)—the biggest climate legislation in U.S. history—and the urgent effort underway to protect its clean energy tax credits.

CCL’s Content Marketing Manager Elissa Tennant joins CCL’s Research Manager Dana Nuccitelli to break it all down. You’ll learn what the IRA funds, how clean energy tax credits work for individuals and businesses, and why these policies are now under threat. Dana also explains the budget reconciliation process, the challenges in Congress, and the surprising level of bipartisan public support for clean energy investment.

You’ll leave this episode knowing exactly why clean energy tax credits matter — and what simple actions you can take to defend it.

Featured Guests:

- Elissa Tennant is CCL’s Content Marketing Manager, leading strategy and creation for web, social media, and volunteer resources.

- Dana Nuccitelli is CCL’s Research Manager, an environmental scientist, and an award-winning climate journalist with a background in physics and over a decade of science communication experience.

Listen Now!

Resources Mentioned:

- 📄 Take action to defend clean energy tax credits: cclusa.org/IRAdefense

- 📅 Register for the 2025 Citizens’ Climate Lobby Summer Conference: cclusa.org/conference

- 🌟 Get involved with other climate actions: cclusa.org/action

- 🦖 Schoolhouse Rock: Tyrannosaurus Debt (explainer video): Watch on YouTube

- 🧠 Join CCL’s Nerd Corner (for policy deep dives): CCL Community – Nerd Corner

Highlights:

- Why the Inflation Reduction Act focuses so heavily on clean energy.

- What “tax credits” mean for individuals, businesses, and the broader economy.

- How budget reconciliation works—and why it’s mostly a partisan process today.

- Why Republicans and Democrats alike have reasons to support clean energy tax credits.

- How CCL volunteers are defending climate investments—and how you can help.

We Want to Hear from You

Email: radio @ citizensclimate.org

Text/Voicemail: 619-512-9646

Social Media: Follow us on X, Instagram, LinkedIn, Facebook, and TikTok.

Transcript

Peterson Toscano:

Welcome to Citizens Climate Radio, your climate change podcast. I’m Peterson Toscano.

Each month, we take you behind the scenes of climate policy. We break down what’s happening in Washington and beyond, and we share real steps you can take to make a difference.

Today, we are going to do something new. In this episode, CCL’s Elissa Tennant teams up with our policy wizard, Dana Nuccitelli. They’ll unpack what’s going on with the IRA.

No, not the Irish Republican Army. You’ll find out what the IRA is—but you probably know already, if you’re listening to this podcast—why the IRA matters and how you can help.

Elissa and Dana join us to talk about CCL

Peterson Toscano:

Elissa and Dana, welcome to today’s show.

Elissa Tennant:

Hello, hello. Good to be here.

Dana Nuccitelli:

Hi, Peterson.

Peterson Toscano:

What is your title, Dana?

Dana Nuccitelli:

I am CCL’s Research Manager..

Peterson Toscano:

a.k.a. policy wizard. Since you’re going to be on the show a lot the next few months, I thought it’d be great for you to tell the listeners a bit about yourselves and what you do for CCL.

But before that, I have an icebreaker for you.

If you could title your very own climate bill, what would it be?

Peterson Toscano:

If you could title your very own climate bill, what would it be and why?

Elissa Tennant:

I will go first, Dana, if that’s cool. I’m already going. If I could title a climate bill, I would call it the “Future Generations Security Act.”

I was browsing LinkedIn on Earth Day, as one does, and I saw this quote that I fear-ate a little bit. It said, “The Earth is not something we inherit from our ancestors; it’s something we borrow from our children.” And I feel like that hit.

I think that the Future Generations Security Act would have broad appeal and speak to that need to protect the Earth for our children—not that I have any.

Peterson Toscano:

Great. I love that.

Elissa Tennant:

Wow.

Dana Nuccitelli:

You put a lot of thought into that answer. Well done. We’ve got the Inflation Reduction Act, and I always felt it should be called the Climate Changed Reduction Act. So I’m going to go with that simple answer.

Peterson Toscano:

Oh, good. I like that.

Elissa and Dana are content marketing managers at Climate Change Now

Peterson Toscano:

Could you tell the listeners just a little bit about yourselves? Whatever you want to share about your own lives and what you do at CCL.

Elissa Tennant:

Yeah. So I am the Content Marketing Manager at CCL. I work on CCL’s marketing team. Every video, social media post—I make content. I make cool stuff.

I like to call myself a metaphorical air traffic controller, deciding what gets made based on our messaging, what kind of bills are running through Congress, and what we want to say to the people.

Dana Nuccitelli:

I’m an environmental scientist and a climate journalist. As the Research Manager, I keep up with the latest climate science research and policy and do a lot of education of our volunteers. And I make social media videos when Elissa forces me to, which is all the time.

Peterson Toscano:

All the time.

Dana Nuccitelli:

All the time.

Peterson Toscano:

Well, great. I’m excited that you’re going to be here. I’m going to take a back seat on this one and just sort of let you go for it. I’ll listen and learn, as I really need to do.

So thank you, Elissa and Dana, for taking over the show today, listener. I leave you in capable hands.

Elissa Tennant:

Thank you, Peterson, for having us.

Elissa Tennant:

Before we dive into the show, I just want to mention that Dana and I will be live and in person at CCL’s summer conference this July in Washington, D.C., which is a great opportunity to lobby your members of Congress on the Hill, but also have a full, jam-packed day of action preparing you to meet with your members of Congress.

If you want to join us there, please visit cclusa.org/conference.

But now, let’s talk about the Inflation Reduction Act, which is the aforementioned IRA and the clean energy tax credits that come with it.

Citizens Climate Radio is digging into the Inflation Reduction Act

Elissa Tennant:

I’m Elissa Tennant. Welcome to Citizens Climate Radio. Today, I am joined by Dana Nuccitelli, CCL’s Research Manager—recently got a promotion, shout out!

We are digging into the Inflation Reduction Act—what it is, how it works, and why the clean energy tax credits in this historic act are suddenly under threat.

So if you’re hearing phrases like “tax credits” and “budget reconciliation” and feeling your eyes glaze over, please do not worry. We are in this together. We’ve got you. Dana and I are going to walk you through it.

The Inflation Reduction Act was passed in August of 2022

Elissa Tennant:

Let’s start with the big picture, Dana. What is the Inflation Reduction Act, when did it pass, and why is it such a big deal for climate?

Dana Nuccitelli:

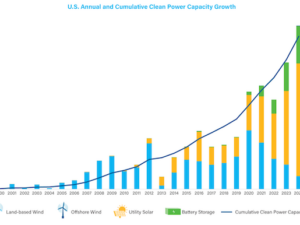

The Inflation Reduction Act was by far the biggest climate bill that the United States has ever passed.

We passed it in August of 2022. It’s a big deal for the climate because it has lots of investments in clean energy that will result in a big reduction in climate pollution over the next decade or so—assuming it stays in place.

Elissa Tennant:

Throwback to your climate bill fantasy—you said you would have called it the Climate Changed Reduction Act.

Why wasn’t it called that? Why didn’t they take that brilliant idea and run with it? Why is it the Inflation Reduction Act?

Dana Nuccitelli:

It was a nice bit of marketing because everybody was very, very worried about inflation at the time—and still is.

So they called it the Inflation Reduction Act to make sure it would be very popular.

And to be fair, in the long term, it should reduce the risks of inflation because fossil fuels tend to be a big contributor to inflation.

Their prices are very volatile—the price of oil can go up and down quite a bit.

If we can reduce our reliance on fossil fuels like oil over the long term, that will reduce future risks of inflation.

So it’s kind of a long-term inflation reduction risk act.

But just calling it the Inflation Reduction Act was a nice bit of marketing.

Elissa Tennant:

I think I am biased, but I’m a really big fan of nice marketing. So I will allow Inflation Reduction Act to stand. Fine.

One of the IRA’s most powerful tools is this concept of clean energy tax credits. So can you break down why we are here today?

What actually are these clean energy tax credits?

Dana Nuccitelli:

Yeah, the bill had a whole bunch of different clean energy tax credits.

There are a couple of categories. There are investment and production tax credits for clean electricity and manufacturing.

So you can think about an example of a solar panel. If you are investing in a facility to manufacture solar panels, there’s a tax credit for that.

And then if you have a facility that’s manufacturing solar panels, you get a tax credit for the solar panels that you’re manufacturing.

Those solar panels can then go into building a solar generation facility—a solar farm.

If you’re investing in building a solar farm, you can get a tax credit for that.

Or if you are producing solar energy from an existing solar farm, you can get a tax credit for that too.

That’s one big category.

There’s also tax credits for things like carbon capture and storage, hydrogen, and nuclear power.

Then there are also a category of tax credits for consumers.

Some examples are:

- Electric vehicles (there’s a tax credit for new, used, and commercial EVs, and for leasing an electric vehicle).

- Home energy efficiency improvements or electrification with technologies like heat pumps.

- Putting solar panels and battery systems on your roof if you’re a homeowner—or you can do it as a business owner too.

Those are some of the main ones, but there are even more.

Elissa Tennant:

Wait, let’s talk more about the tax credits for the run-of-the-mill people.

I’m not at heat pump levels of income yet, but I am maybe at home energy audit levels.

Does it still cover that?

Dana Nuccitelli:

Yes!

There is a tax credit for home energy audits.

If you get an expert to come in and look at your house and figure out the most efficient things you can do to improve your home energy efficiency, there’s a 30% tax credit for that.

So if you spend $450 on that, you can get a $150 tax credit.

They’ll tell you: improve your windows, your insulation, your doors—and you can get tax credits when you make those improvements as well.

Elissa Tennant:

Fantastic.

But we are kind of focusing on the business side of tax credits today, right?

I just want to know about the individual side for like… my personal own gain and use.

Dana Nuccitelli:

They’re both important.

Elissa Tennant:

Alright, so these clean energy tax credits for individuals and businesses—and everybody who can benefit from the Inflation Reduction Act—they are under threat.

So let’s talk about that.

Let’s take a little turn here and go down the not-as-fun part.

Not as fun as talking about home energy audits.

Dana Nuccitelli:

Yeah, it’s a little more wonky.

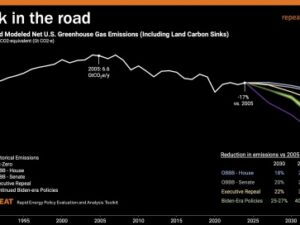

So back in 2017, the last time Republicans had full control of Congress, they passed a bunch of tax cuts.

Those tax cuts are starting to expire—they last for a little bit under a decade.

So they’re nearing expiration now.

Now that Republicans are back in charge, they want to extend those tax cuts.

Doing so is going to cost a lot of money—something north of $4.5 trillion over the next decade, depending on exactly what they decide to do.

And a lot of people are also worried about the size of our national debt, which is getting close to $37 trillion now.

So if you add another $4.5 trillion to it, that’s more than a 10% increase in our already very large national debt.

They would prefer not to just do the spending without paying for it.

So they’re looking for “pay-fors,” as we call them.

The Inflation Reduction Act is one place to get some money to pay for those tax cut extensions, because we invested something like a trillion dollars over the coming decade in the IRA, largely in those tax credits.

That’s why they’re on the chopping block—with a big target on their back—to be used as a “pay-for” to extend those expiring tax cuts.

Elissa Tennant:

Do you ever watch Schoolhouse Rock where the national debt is an animated Tyrannosaurus rex that wanders through the nation’s capital and eats things?

Dana Nuccitelli:

I don’t think I saw that.

I saw the one like “Here’s how a bill becomes a law,” but I don’t think I saw the T-Rex.

Elissa Tennant:

This is a deep cut, okay?

Only the real ones know about the Tyrannosaurus debt, apparently.

But whenever we talk about the national debt, that’s all I think about—is this Schoolhouse Rock animated T-Rex.

That being said, so—we need to pay to extend the tax credits.

I’m repeating it back to you—this is an active listening technique—to make sure I understand.

We need to pay for the extension of tax credits—

Dana Nuccitelli:

Tax cuts.

Elissa Tennant:

—Tax cuts.

We need to pay for the extension of tax cuts.

And in order to do that, we need to find ways to cut our spending as a federal government.

There are a lot of other things on the chopping block, but we at Citizens’ Climate Lobby are focused on the IRA and the clean energy tax credits.

Dana Nuccitelli:

That’s right. You got it.

Elissa Tennant:

We are a climate org.

Okay. That makes sense to me.

We can move on.

Elissa Tennant:

So let’s talk about budget reconciliation.

This is something that has come up quite a bit in recent years.

I don’t think it was really a big topic a decade or so ago.

It sounds like something from a government finance class—and I fear it a little bit.

So what does it mean in practice?

And why is it such a big deal for climate?

How does budget reconciliation fit into all this?

Dana Nuccitelli:

Yeah, so the issue here is that the Senate has the 60-vote filibuster that makes it hard for the Senate to do very much.

Forty percent of the Senate can just block progress on a particular piece of legislation if they so desire.

Congress decided that getting a budget done each year is a really important thing to do.

So they carved out an exemption from the Senate filibuster for budgetary negotiations—and that’s what budget reconciliation is.

The Senate can do it once or twice per year.

Anything that goes into a budget reconciliation package has to be specifically focused on the budget.

They can’t, for example, change regulations that don’t have any budgetary cost and stick that into budget reconciliation—that’s not allowed.

Things like tax cut extensions, tax credit additions or repeals—those can all get put into a budget reconciliation package that then only needs 50 votes to pass in the Senate, along with a majority in the House.

Elissa Tennant:

I have many questions, and the first one is a question I’ve wanted to ask for so long but I’m too scared because it’s been too long:

Why is it called a filibuster?

That sounds more like a candy bar.

Dana Nuccitelli:

I have no idea why it’s called the filibuster.

Elissa Tennant:

At least you also don’t know.

Filibuster—anybody listening, if you know why it’s called a filibuster, please write in, because our Research Manager doesn’t know.

We stumped him on this one.

Dana Nuccitelli:

I failed.

I failed.

Sorry.

Elissa Tennant:

Oh my God.

So the budget reconciliation process does not require the filibuster candy bar as part of it.

How do they decide what is budgetary and what isn’t?

How is it decided what is allowed in budget reconciliation and what isn’t?

Like, if you tried to do something that was stepping over the line?

Dana Nuccitelli:

Generally speaking, it just has to have some kind of component that generates revenue for the government or costs the government some money.

That’s the focus.

They can ask the Senate Parliamentarian whether it is budgetary in nature.

The Senate Parliamentarian will make a ruling and say, “Yes, you can include it in budget reconciliation,” or “No, you can’t.”

The Parliamentarian is kind of like the cop of Congress—and the Senate actually listens to the Parliamentarian and does what they say.

Elissa Tennant:

Who’s the Parliamentarian?

I feel like we should all know who this person is.

Dana Nuccitelli:

I forget what her name is, but she’s been the Parliamentarian for quite a while.

She’s the Senate rules expert.

Elissa Tennant:

Good for her.

Dana Nuccitelli:

Yeah.

Elissa Tennant:

Fantastic.

Elissa Tennant:

Alright, so this simple process that lets Congress pass a budget with just a simple majority—budget reconciliation.

Where are we in this process right now?

What’s the timeline?

And again, how do those IRA clean energy tax credits fit into all of this?

Lay the land.

Dana Nuccitelli:

Yeah, so each relevant committee in the Senate and the House is given a broad outline of, “Here’s how much money you can spend,” or, “Here’s how much you have to cut.”

Then they work on the details of how they’re going to meet that broad outline.

That’s what they’re doing now—one at a time—coming up with their committee’s specifics.

Once those are all released into the wild, all the members of the House and the Senate look at them and decide if they can vote on it or say,

“I can’t vote for something that’s got this provision, so you need to change it.”

Then they have negotiations.

Ultimately, they come up with one big package that supposedly can get a majority of votes in both the House and Senate.

The House and Senate will each release their packages, and they have to agree to a reconciled version—so that one package can get a majority in both chambers.

Because the House and Senate might have different priorities and disagree.

Elissa Tennant:

It’s a reconciled package!

Budget reconciliation.

Okay.

I was about to ask where the reconciliation term came from too, so you were way ahead of me there.

They come out with two versions of it.

We at CCL always refer to budget reconciliation as largely a partisan process.

I feel like now’s a good time to dive into why it is largely a partisan process and why we call it that.

Dana Nuccitelli:

It wasn’t always a partisan process.

In the past, when there was more bipartisan negotiation that tended to be more successful—when there was less partisanship in Congress—then the budget reconciliation process was just to make sure they could get something passed with a majority of votes.

It didn’t necessarily have to be all Republicans or all Democrats.

It was just 50 votes in the Senate.

But over time, Congress became more partisan, more divided, and so it became a partisan process—whichever party was in the majority could get what they needed done in the Senate.

That’s why it’s become a partisan process.

It wasn’t always one—and it doesn’t have to be one.

It just is right now.

Elissa Tennant:

And there is a large, vast future ahead of us.

But for this exact moment, that’s why it’s largely a Republican process—as they hold a majority in the House and the Senate.

Elissa Tennant:

Okay, back to the lay of the land.

So where are we in the budget reconciliation process?

Dana Nuccitelli:

Yeah, so each committee is in the process of releasing their plans for how they’re going to meet their broad budgetary rules.

In terms of the Inflation Reduction Act tax credits:

- In the House, it’s the Ways and Means Committee that’s in charge.

- In the Senate, it’s the Senate Finance Committee that oversees the IRA tax credits and other important tax-related provisions.

So we are going to see what they have planned—and we’ll hope they preserve some stuff from the IRA.

And we’ll try to convince them to preserve the important stuff.

Elissa Tennant:

Side note: I think “Ways and Means” is an excellent committee name.

It’s just vague enough that I have no idea what they actually do—but they seem very prestigious and important.

In terms of marketing, they really nailed that one.

Dana Nuccitelli:

They have the ways.

They have the means.

Elissa Tennant:

They do.

Whatever—the Things and Stuff Committee.

Mysterious and important.

Dana Nuccitelli:

Yes, that’s what they should call it. The Mysterious and Important Committee.

Elissa Tennant:

The work is mysterious and important.

Shout out Severance.

What’s your favorite IRA tax credit? If you had to pick one…

Elissa Tennant:

So what’s your favorite IRA tax credit?

If you had to pick one—you have to pick one, actually. It’s not an “if.”

Dana Nuccitelli:

That’s a good question.

I think I have to say the clean electricity tax credits, because they’re so important and they’re going to do so many things:

- Help us deploy a lot more clean electricity.

- Help us meet rising energy demand.

- Reduce home electricity bills.

- Create a lot of construction jobs.

They’re also the most important provision for reducing climate pollution.

According to modeling, they’re responsible for about half of the Inflation Reduction Act’s climate pollution reductions.

So for all those reasons—because they’re so important—clean electricity would have to be my favorite.

Although, if I were being more biased and selfish, I would say the home weatherization tax credits—because I recently upgraded my 70-year-old windows on my house just last year.

And I was able this year to take the tax credit for that and reduce the amount of taxes that I owed.

So I really appreciate that tax credit for selfish reasons too.

Elissa Tennant:

That’s how I feel about the induction stove tax credit.

When I got my induction stove last year—just because our old electric stove (this house is 105 years old)—when it finally gave out, I got the induction stove.

And I invited people over to watch me boil water.

I was like, “Do you want to come over and have like a spaghetti party? It’s so fast—you’ll love it.”

So I agree. That was a big one.

I thought you were going to say—I don’t even know why I know about these—but the USDA REAP credits, the agriculture ones.

Because you’re a big silvopasture fan.

Dana Nuccitelli:

Well, the REAP program’s not a tax credit. It’s more of a grant program.

That’s a good program—and I do love silvopasture (planting trees on pasture land)—but not technically a tax credit.

Elissa Tennant:

Yes. That’s right.

We’ll save that one for a silvopasture episode.

Dana Nuccitelli:

Yeah. Ooh, I like that.

That’s a good idea.

Elissa Tennant:

We’ve established these tax credits are important.

The Inflation Reduction Act is important.

We really need to leave it intact throughout the budget reconciliation process.

So let’s talk about why this really matters.

What would we lose if these tax credits go away?

What’s at stake?

Dana Nuccitelli:

There’s a lot at stake.

We would lose a big chunk of climate pollution cuts.

We would lose—uh, I hate this—a whole bunch of domestic manufacturing facilities and jobs, local revenue that goes to communities where those facilities are located.

Our electricity bills would go up, because we’d get less of this cheap, clean electricity.

So there’s all kinds of bad stuff that would happen that I don’t think anybody wants to see.

We’re going to try very hard to convince our members of Congress to keep these important tax credits in place.

Elissa Tennant:

Yeah.

Can we get a “vibe check” on aisle America?

How are people feeling about the tax credits in general?

Do we have a general public opinion on the Inflation Reduction Act’s clean energy tax credits?

Dana Nuccitelli:

Yes.

There was just recently a survey released by the University of Maryland that asked specifically about a bunch of these tax credits.

They found that all of them they asked about were very popular—across the political spectrum.

Actually, the least popular one they asked about was the tax credit for new electric vehicles, which is a $7,500 credit if you qualify and are purchasing a new EV.

Even that one—among Republican voters—had 71% support, with 29% wanting to repeal it.

So even the least popular tax credit among Republicans was still roughly 2.5 to 1 in favor.

They’re all very, very popular, because they do so much good stuff.

And who doesn’t like to get a tax credit?

Elissa Tennant:

I can’t imagine people wouldn’t want to get a tax credit for their clean energy purchases. That makes sense to me.

Yeah, so these are important. We want to keep them intact.

What can listeners do right now to help protect these tax credits?

Dana Nuccitelli:

Well, we at CCL have been doing stuff to help protect them since, like, last December.

We’ve had our volunteers—whose members of Congress are on the House Ways and Means Committee and the Senate Finance Committee—contact those representatives and tell them about the importance of the tax credits.

We’ve had lots of actions where our members have contacted their members of Congress, especially Republican members, asking them to support and preserve the IRA tax credits.

We had a conservative conference where our conservative volunteers went to Washington, D.C., had training, and lobbied almost 50 Republican members of Congress about the IRA tax credits and a few other things.

So we’ve been doing a lot.

Of course, we have our Summer Conference, as you mentioned, between July 20th and 22nd—where we will again, most likely (assuming this question hasn’t been settled yet, which it probably won’t be), be lobbying on the Inflation Reduction Act again.

We’ve also got a database that I put together of all the different facilities and projects the IRA has helped incentivize all across the country—like the number of jobs created, local revenue—and we’re using that to inform our lobbying.

We’re doing a whole lot.

So one thing people can do is join their local Citizens’ Climate Lobby chapter to help us with these lobbying efforts—or just contact their member of Congress directly and tell their story, to help convince Congress to keep these tax credits in place.

Elissa Tennant:

Dana, you just named so many things.

So I’m going to give people one thing.

Dana Nuccitelli:

Okay, one thing’s good.

Elissa Tennant:

That was so many things.

Dana Nuccitelli:

What’s the one thing?

Elissa Tennant:

The one thing I would say is:

If you are represented by a Republican member of Congress, you can write their office right now asking them to protect the Inflation Reduction Act’s clean energy tax credits.

We have a tool that makes it super easy: cclusa.org/IRAdefense

That’s cclusa.org/IRAdefense

Now a lot of people will say, “Well, I’m not represented by a Republican, but I still want to help.”

And you totally can.

You can share that link on your social media accounts.

Send it directly to your friends and family who are represented by Republican members of Congress. Spread the word.

Budget reconciliation is a really long process—like you said, this question probably will not be answered by the time our conference rolls around in July.

So we need to keep the conversation going.

The more we keep it going, the more important these tax credits are to the general public.

So bring it up at parties.

Talk about it at your next open mic night.

Take out a billboard.

Or just share this episode with anybody you think might be interested in learning more about the Inflation Reduction Act’s tax credits.

And once again—please join us July 20th through 22nd in Washington, D.C., at the Citizens’ Climate Lobby Summer Conference.

You can learn more and sign up at cclusa.org/conference

It’s the perfect opportunity to get up to speed on climate policy, build community, and meet directly with lawmakers to defend these tax credits and more.

And you don’t have to be a policy expert—because I clearly am not.

I am just someone who cares.

Again: cclusa.org/conference

Elissa Tennant:

I have one last question for you, Dana.

What gives you hope that we can keep these programs alive?

Why are we still going at this?

Dana Nuccitelli:

The good news is that a lot of Republican members of Congress have already expressed that they want to preserve at least some of these important tax credits.

There have been a number of letters from groups of Republicans to their leadership saying,

“Hey, let’s be careful about what we’re getting rid of here.”

Because there are a lot of great benefits—especially in Republican districts—

battery manufacturing, EV manufacturing facilities, big solar and wind farms…

These things generate local jobs and local revenue.

It doesn’t look good if you vote to repeal a policy that’s creating a bunch of jobs and economic growth in your district.

So it’s in their interest to preserve a lot of these tax credits.

I’m hopeful we’ll be successful in preserving at least some of the more important provisions from the Inflation Reduction Act.

Elissa Tennant:

Hear, hear.

Peterson, myself, and hopefully the listener agree with you.

Thank you, Dana!

The next episode, I think, might be about the Foreign Pollution Fee Act, which was just introduced in Congress a short time ago.

We’re doing a training on that for our volunteers coming up, so I think we have a lot to talk about—

unless we decide to skip it and just…

Dana Nuccitelli:

Go straight to silvopasture!

Elissa Tennant:

Who knows—both good topics.

Thank you for listening.

We’ll give it back to Peterson to close things out.

Dana Nuccitelli:

Thanks, Elissa.

Peterson Toscano:

Elissa, Dana—I need to thank you for that amazing overview.

I understand this so much more clearly than I did before.

I mean, I thought I knew about the Inflation Reduction Act, but I really lost the thread at some point.

You brought it all back for me. Thank you.

Dana Nuccitelli:

Thank you.

Elissa Tennant:

I thought it was just you doing the outro—I was sitting back.

Peterson Toscano:

Just sit back. You don’t have to do anything—you did all your hard work.

Elissa Tennant:

Yeah.

Peterson Toscano:

You can talk to me!

Elissa Tennant:

That’s alright.

Peterson Toscano:

You’re allowed.

Yeah, I just—I learned so much. So thank you very much.

Elissa Tennant:

Thank you, Dana.

I am happy to help facilitate a conversation about the Inflation Reduction Act at any party.

Peterson Toscano:

I have one request.

Whenever you talk about having created a database, can I call it a “Danabase”?

Elissa Tennant:

A…

Dana Nuccitelli:

The Danabase! That’s a good name. I like it.

Peterson Toscano:

Yeah, come back and talk more, because we need to know about this policy.

And I have to say—it’s one of the areas I’m weakest in.

As people who do climate work, it’s easy to lean into the places where we have strength because it’s comfortable.

But we all have to learn new tricks and adapt all the time—to climate change, and to climate policy.

So thank you so much. I’m looking forward to much more.

Elissa Tennant:

Thank you, Peterson.

Dana Nuccitelli:

We’re all going to learn and grow together.

Peterson Toscano:

Yay. And thank you for listening to Citizens Climate Radio.

If you are ready to take action to protect clean energy tax credits, visit cclusa.org/IRAdefense.

And don’t forget—you can join us in person.

And when I say “join us,” I mean Elissa, Dana, and I will all be at Citizens’ Climate Lobby’s Summer Conference.

It’s happening from July 20th to 22nd in Washington, D.C.

Learn more and sign up at cclusa.org/conference

In fact, I think you should just type in cclusa.org/[whatever you like] and see if it comes up as an actual page on the website.

Elissa Tennant:

Hey…

Peterson Toscano:

Do you have a story or a question you’d like to share?

Call or text our listener line: (619) 512-9646.

That’s (619) 512-9646.

You’ll find show notes and links to our hosts—all of us are hosts today, it feels like—at cclusa.org/radio.

Be sure to follow us on Instagram, X, Facebook, LinkedIn, and yes, TikTok.

Just search for Citizens Climate Radio.

This episode was written by Elissa Tennant, Dana Nuccitelli, Lesley Beatty, Elise Silvestri, and me—Peterson Toscano.

Production by Elise Silvestri and me.

Music comes from Epidemic Sound.

Citizens Climate Radio is a project of Citizens Climate Education.

I’ll see you next time—but in the meantime, stay strong, determined, and creative in your work on climate change.