Episode 105: What’s at Stake for Clean Energy Tax Credits?

In this second episode of our new policy mini-series, CCL’s Dana Nuccitelli and Elissa Tennant return to break down the latest developments in the ongoing fight to defend the Inflation Reduction Act’s (IRA) clean energy tax credits.

With the Senate Finance Committee’s budget text now public, Dana and Elissa compare how the Senate version stacks up against the House Ways and Means Committee’s bill — and what it all means for our energy bills, manufacturing sector, and climate targets.

💸 Spoiler alert: If key tax credits are repealed or weakened, households could face up to $3,000 in higher energy costs over the next decade, and the U.S. could lose hundreds of thousands of clean energy jobs.

Listen Now!

🎙️ In this episode:

- What the “Byrd bath” process is, and why it matters

- Why transferability of tax credits is essential for small clean energy businesses

- What’s really behind the “Foreign Entities of Concern” language

- How repealing credits affects electric vehicles, clean energy buildout, and climate pollution

- Action steps for advocates

📬 Listener Questions: Energy Efficiency and Podcast Joy

In this episode, we feature two insightful voicemails from listeners. One caller asks about the real-world impact of removing the 45L energy-efficient homes tax credit and the potential loss of the long-standing Energy Star program. Dana breaks down how these changes would raise household energy bills and reduce incentives for smarter energy use. Another listener shares how Citizens’ Climate Radio boosts their mood and motivation, even when the topics are tough—reminding us why we do this work.

🌟 Leadership Update: Meet Ricky Bradley

We close the episode with a major announcement from CCL Board Chair Bill Blancato: Ricky Bradley will become Citizens’ Climate Lobby’s Interim Executive Director starting July 16, 2025. Ricky has been with CCL since 2012, starting as a volunteer and later launching key initiatives like Citizens’ Climate University and CCL Community. Ricky shares heartfelt reflections on his journey with CCL and his vision for leading the organization into its next chapter.

🔗 Mentioned in the episode:

- CCL’s action page to defend clean energy tax credits

- Overview of the Senate Finance Committee’s proposed budget

- Energy Innovation modeling on IRA repeal

- Princeton’s REPEAT Project

- U.S. DOE info on the 45L tax credit

- Energy Star program background

We Want to Hear from You

Join the conversation over at The Nerd Corner

Email: radio @ citizensclimate.org

📞 Listener Line: Call or text us at +1-619-512-9646 with your comments or questions.

Social Media: Follow us on X, Instagram, LinkedIn, Facebook, and TikTok.

🎟️ Join us in person: Register now for the Citizens’ Climate Lobby Summer Conference and Lobby Day happening July 20–22, 2025, in Washington, D.C.

Transcript

Citizens’ Climate Radio – Episode 105

Title: What’s at Stake for Clean Energy Tax Credits

PETERSON TOSCANO:

Welcome to Citizens’ Climate Radio, the podcast that helps you understand the climate policy news behind the headlines. I’m Peterson Toscano.

Each month we bring you timely updates from Capitol Hill and beyond, breaking down complex topics and showing how you can make an impact.

In this episode, you’ll hear big news from Citizens’ Climate Lobby regarding our leadership. But first, we’re continuing our new series with CCL’s Elissa Tennant and Dana Nuccitelli. They team up to help you navigate the fast-changing world of climate legislation.

Today, they’re diving into the latest news and research on the Inflation Reduction Act—and how repealing it would hurt American families and businesses. So what’s in the new text, what’s at stake, and how can climate advocates respond?

Elissa and Dana, welcome back to the show.

ELISSA TENNANT:

Glad to be here. Thanks, Peterson.

PETERSON TOSCANO:

Before we dive in, what’s one climate policy term or phrase you wish more people understood—and why?

DANA NUCCITELLI:

I’m going to say the concept of net zero emissions, which means you’re pulling as much carbon out of the atmosphere as you’re adding in a given year. So you’re not increasing the amount of greenhouse gases in the atmosphere.

Some people argue that’s not good enough because our emissions aren’t literally zero. Others say it’s impossible to reach. But not only is it possible—it’s a good target. Once you reach net zero emissions, that’s when global warming stops. And that’s the whole goal.

ELISSA TENNANT:

And mine segues nicely into our discussion. My term is budget reconciliation. It’s not directly a climate-related term, but I had never heard of it before I came to Citizens’ Climate Lobby. It impacts so many policies, including climate and energy. I wish more people understood it—but I get it, it’s a really long process.

PETERSON TOSCANO:

Same. It was a new thing for me too. I love those answers.

Thanks so much—and thank you for taking over the mic today. Listener, you are in excellent hands. I’ll be back at the end of the show.

🎯 Chapter 1: Senate Budget Breakdown

ELISSA TENNANT:

Thank you, Peterson. And thank you for listening and for joining us. Later in the show, we’ll share some listener voicemails and our responses—and let you know how you can leave your own voicemail or question for us.

But first—Dana, we are knee-deep in budget reconciliation. Let’s talk about it.

Our last episode covered the release of the House Ways and Means Committee’s version of the budget, which gutted the Inflation Reduction Act’s clean energy tax credits. The House ultimately passed that version, and now negotiations have moved to the Senate.

So let’s set the scene. What’s happening in the Senate right now?

DANA NUCCITELLI:

All of the Senate committees have released their versions of the budget reconciliation bill. The last committee to go was the Senate Finance Committee—they have the most complicated and wide-ranging responsibilities, including decisions about the Inflation Reduction Act’s clean energy tax credits.

They’ve now released their text, and it’s going through what’s called the bird bath, which is when the Senate parliamentarian checks each proposal to make sure it qualifies for inclusion under budget reconciliation rules.

ELISSA TENNANT:

Talk to me more about the bird bath. I don’t know if we mentioned it in our last episode, but we can’t just throw that term out and move on.

DANA NUCCITELLI:

Yeah, we’ve talked about the parliamentarian before—Elizabeth McDonough. Shout out to her.

For a proposal to qualify for budget reconciliation, it must be primarily budgetary in nature. That means the proposal’s main purpose has to be to affect federal spending or revenue. It can’t just be a policy change with minor budget implications.

The parliamentarian reviews all provisions and decides what stays. That process is called the bird bath, named after Senator Robert Byrd from West Virginia, who helped establish these rules.

ELISSA TENNANT:

Okay, and we learn something new every day! So the Senate Finance Committee is essentially the Senate counterpart to the House Ways and Means Committee, right?

DANA NUCCITELLI:

Correct.

ELISSA TENNANT:

That’s what I thought! So let’s get into it: How is the Senate Finance Committee’s proposed budget different from the House bill?

DANA NUCCITELLI:

They definitely made improvements—especially when it comes to clean energy tax credits.

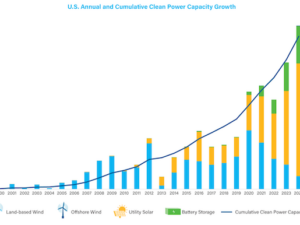

For example, the House version effectively repealed the clean electricity tax credits immediately. The Senate version, though, phases them out more gradually. Solar and wind tax credits would begin phasing out after 2025, tapering through 2027.

Other technologies—like geothermal, nuclear, hydro, and battery storage—get even more runway, with phaseouts beginning in the 2030s. That’s especially good for battery storage, which is key to addressing the intermittency of solar and wind power.

ELISSA TENNANT:

Sounds like a solid improvement. Let’s talk about those so-called “poison pills” in the House version. I want to get into the weeds.

DANA NUCCITELLI:

Let’s do it. One of the biggest issues was the Foreign Entities of Concern rule—FIAC for short.

Basically, the U.S. government maintains a list of countries considered foreign entities of concern—currently China, Russia, North Korea, and Iran. The goal is to reduce our reliance on countries like China for clean energy technology components.

The House version took this idea to the extreme. It said that if any part of your clean energy project came from China—even a single bolt or wire—then your entire project would be disqualified from receiving tax credits. That’s just not realistic.

ELISSA TENNANT:

Right, because we rely on a global supply chain. That rule would have been nearly impossible to comply with.

DANA NUCCITELLI:

Exactly. The Senate version still includes FIAC language, but it’s less extreme. It looks more workable, though folks are still analyzing the details to see if it’s feasible for specific technologies.

Another big difference is on transferability. In the Inflation Reduction Act, clean energy tax credits are transferable. That means small companies that don’t owe a lot in taxes can sell those credits to larger businesses that do—basically creating a marketplace.

The House bill would have rolled that back. Without transferability, small solar and wind companies would have to partner with big banks to monetize those credits. And of course, the banks would take a cut.

ELISSA TENNANT:

So instead of tax credits going to solar panels, they’d be going to financial institutions. Not ideal.

DANA NUCCITELLI:

Exactly. The Senate version preserves transferability, which means those taxpayer dollars are more likely to support actual clean energy projects rather than getting siphoned off in financing deals.

ELISSA TENNANT:

I love a good metaphor, and one we’ve been using on internal calls is: The House bill really dug a deep hole. The Senate version is throwing in a few shovelfuls of dirt to try and fill it back in.

DANA NUCCITELLI:

Right. It’s still not great—but definitely better. The Senate version eliminates some of the most harmful provisions from the House bill.

💸 Chapter 2: What’s at Stake?

ELISSA TENNANT:

And now… we’re going to stop celebrating and talk about the impacts. As our resident nerd, I know you’ve been poring over 10 to 15 studies on what happens if the IRA’s clean energy tax credits get repealed.

So what’s the headline here? What happens if we lose these credits or they get phased out?

DANA NUCCITELLI:

I looked at about 8 to 10 reports. The headline is simple: Repealing these tax credits will make household energy bills go up.

That includes electricity, gasoline, and natural gas. And that’s bad news for pretty much everyone.

ELISSA TENNANT:

How much are we talking?

DANA NUCCITELLI:

Gasoline prices could go up anywhere from 3 to 25 cents per gallon. That’s because eliminating the EV tax credit would mean fewer people buy electric vehicles—and more people buy gas cars. More gas demand = higher prices.

ELISSA TENNANT:

Oof. A little economics lesson there.

DANA NUCCITELLI:

Exactly. Electricity bills would increase by about $100 per year per household. Same goes for vehicle fuel costs—another $100 a year. And if your home uses natural gas, those prices could go up too, because utilities would be relying more on fossil fuels.

All together, average U.S. households could see $1,000 to $3,000 in additional energy costs over the next 10 years.

ELISSA TENNANT:

Okay, I’m going to speak on behalf of the audience: We’re not loving this news.

DANA NUCCITELLI:

Yeah, no one wants to pay an extra two grand just because Congress gutted a clean energy policy.

ELISSA TENNANT:

And that’s just the household side. What about jobs and manufacturing?

DANA NUCCITELLI:

We’ve seen a clean energy manufacturing boom since the Inflation Reduction Act passed—especially in EVs, batteries, and solar panels. Companies invested based on the expectation that these tax credits would stick around.

If those credits disappear, demand drops. And when demand drops, companies stop building new factories—or even close existing ones.

The Princeton REPEAT Project estimates that repealing the EV tax credit could result in 20 to 40 million fewer EVs on the road by 2035. That kind of drop means we may already have too much manufacturing capacity. Companies could start laying off workers.

ELISSA TENNANT:

This whole conversation is painful. The only way out is through. Let’s talk about jobs.

DANA NUCCITELLI:

Right. So if demand for clean energy drops, the need for manufacturing drops, and we lose jobs.

It’s not just factory jobs. It’s also the people who build wind and solar farms—construction workers, electricians, and so on. If the House version passed as-is, clean power deployment would be cut in half over the next decade.

Even the Senate version, while better, would still result in fewer projects being built than if we kept the full IRA incentives. That means hundreds of thousands of lost jobs in clean energy manufacturing and construction.

And remember, those workers spend money in their communities. Fewer jobs means less local spending, which means more job losses across the economy.

ELISSA TENNANT:

So we’re talking about higher household costs, fewer clean energy projects, massive job losses… and shrinking GDP?

DANA NUCCITELLI:

Yes. Analysts estimate the IRA repeal would reduce GDP by about $1 trillion over the next 10 years.

And that’s the kicker: lawmakers are trying to save half a trillion by repealing the tax credits—but it’ll cost the economy twice that in lost output. It’s not fiscally smart.

ELISSA TENNANT:

Tell me that’s the last of the bad news?

DANA NUCCITELLI:

Not quite. More fossil fuel use means more air pollution. One report I reviewed projected thousands of additional premature deaths due to smog, particulates, and other pollutants from burning gas and coal.

There are also increases in asthma, heart disease, even dementia. And of course, there’s climate pollution—greenhouse gas emissions will rise if we roll back these clean energy programs.

ELISSA TENNANT:

So not only would we fall short of our climate targets, we’d be rolling back gains in public health and energy affordability?

DANA NUCCITELLI:

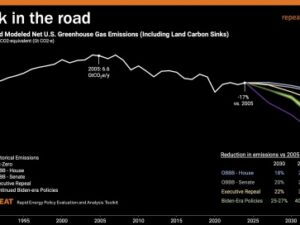

Exactly. If this repeal effort goes through, the U.S. will only achieve a 20–30% reduction in greenhouse gas emissions from 2005 levels by 2030.

Our Paris Agreement target is 50%. So we’d be well short—unless Congress changes course.

🔌 Chapter 3: Energy Security & Grid Strain

ELISSA TENNANT:

Let’s talk about energy security. What happens if we roll back clean energy investments at the same time electricity demand is rising?

DANA NUCCITELLI:

That’s a big problem. Right now, we’re seeing a sharp increase in electricity demand—faster than anything in the past 20 years.

Why? A few reasons:

- Data centers, especially for artificial intelligence, use a ton of power.

- More people are buying electric vehicles.

- Homes are switching to electric heat pumps.

- And hotter temperatures from global warming mean more air conditioning.

All that adds up to a projected 5 to 10 times faster growth in power demand compared to previous decades.

ELISSA TENNANT:

Wow.

DANA NUCCITELLI:

Yeah. And if we strip away the financial incentives for building new clean power sources, we won’t be able to keep up with that demand.

That means we’re at risk of blackouts and grid instability—especially in the summer, when power use spikes.

ELISSA TENNANT:

Why are solar and wind getting the short end of the stick here? What did they ever do?

DANA NUCCITELLI:

Some lawmakers argue that solar and wind are “mature technologies” and don’t need help anymore.

And it’s true—they’ve gotten cheaper. But clean energy projects still rely on long-term financial modeling, and if you suddenly yank away the incentives, it disrupts those plans.

A gradual phaseout makes more sense than ripping off the bandage.

Also… let’s be honest. The Trump administration has had a long-standing dislike of wind power. Wind energy got treated especially badly in both the House and Senate proposals.

ELISSA TENNANT:

Just for the record, I’m squinting my eyes in disapproval at that statement. Deep squint.

All right… are there any more bad impacts? Or can we finally move on?

DANA NUCCITELLI:

We can move on—but just one more: repealing these credits increases climate pollution, and we fall far short of our climate goals.

ELISSA TENNANT:

We love hearing from you, the listener. And today, we’ve got two voicemails to share.

Dana, the first one’s for you.

Listener voicemail:

Hi there. I really enjoyed your recent episode on saving clean energy tax credits. I’d love to hear a deeper dive into how removing the 45L tax credit and possibly ending the Energy Star program would impact homeowners—especially their monthly energy bills.

These programs seem so important in helping people lower utility costs, and I think that message needs to be clearer when lobbying Congress.

Thanks again—great show!

DANA NUCCITELLI:

Great question. The 45L tax credit is for building new homes that meet energy efficiency standards—think solid insulation, good windows, and Energy Star appliances. It gives developers an incentive to build efficient homes.

The Energy Star program itself is a consumer guide. If you see the sticker, you know you’re getting an energy-efficient appliance.

Repealing these would do two things:

- Raise energy bills for families living in new homes.

- Accelerate demand on the grid at a time when electricity use is already rising.

We’ve kept energy use relatively flat for the last 20 years largely because of programs like Energy Star. Removing them now, when demand is spiking, is a recipe for even higher bills.

ELISSA TENNANT:

So… we need a third-party Energy Star label. Someone out there, please start that and we’ll give you a shoutout on the show.

Our second voicemail comes from a longtime CCL volunteer.

CRAIG PRESTON (voicemail):

Hello, Peterson and the team. This is Craig Preston from the Orange County Coast Chapter.

I’ll be honest—I’m always tempted to skip a 40-minute podcast. But every time I listen, Citizens’ Climate Radio gives me a boost of inspiration and energy for activism.

Thanks for the gift of this show.

ELISSA TENNANT:

That is so kind. Thank you, Craig. You’re the best. We’ll see you in D.C. this July at the CCL Summer Conference and Lobby Day!

ELISSA TENNANT:

Before we wrap up, one more update—and it’s a big one.

PETERSON TOSCANO:

That’s right. We’ve got some leadership news to share.

BILL BLANCATO (clip from June monthly call):

Hey everybody. I’m Bill Blancato, and I’ve been a CCL volunteer since 2013. In 2014, I helped start the second chapter in North Carolina.

As of June 1st, I’m serving as Chair of the Citizens’ Climate Lobby Board.

The leadership update I want to share is this: Our Executive Director, Rachel Kerestes, has announced she’ll be stepping down effective July 15th.

Together with the board, we’ve offered the role of Interim Executive Director to Ricky Bradley—and I’m happy to say he’s accepted. He’ll officially assume the role on July 16th.

RICKY BRADLEY (clip):

Thank you, Bill. I’m deeply honored by this opportunity.

For those who don’t know me, I started volunteering with CCL in 2012. My first chapter meeting was at my kitchen table—with my spouse and one other person.

Since then, I’ve served in lots of roles—helping to relaunch the website, create CCL Community, and build Citizens’ Climate University. I’ve worked as Regional Coordinator in the South and most recently served as VP of Field Operations.

What makes CCL powerful isn’t just the strategy—it’s the people. The relationships we’ve built together. The passion and the purpose we bring to the work.

PETERSON TOSCANO:

Here at Citizens’ Climate Radio, Ricky holds a special place in our hearts. He was the one who first approached me about creating this podcast—almost ten years ago.

Ricky, congratulations. If you want to see him in action, join us at the Citizens’ Climate Lobby Summer Conference, July 20–22 in Washington, D.C. You can register at cclusa.org/conference.

ELISSA TENNANT:

And as a final reminder—if you’ve got a story to share or a question for the show, call or text our listener line at 619-512-9646. That’s +1 if you’re outside the U.S.

PETERSON TOSCANO:

And don’t forget: you can still take action to protect clean energy tax credits. Head to cclusa.org/IRAdefense to contact your senators.

This episode was written by Elissa Tennant, Dana Nuccitelli, and me—Peterson Toscano. I also recorded and edited the episode. (Though let’s be honest… this one barely needed editing.)

Music comes from Epidemic Sound. Citizens’ Climate Radio is a project of Citizens’ Climate Education.

Stay strong, determined, and creative in your climate work.