Rep. Steve Scalise’s resolution passed on a mainly party-line vote of 237-163. (Photo by Gage Skidmore)

By Steve Valk

On Friday, the U.S. House passed a non-binding resolution — H.Con.Res.89 – “Expressing the sense of Congress that a carbon tax would be detrimental to the United States economy.” The vote was 237-163.

Looking at the breakdown, no Republicans voted against the resolution and six Democrats voted for it.

At first glance, the resolution’s passage appears to be bad news for those hoping Congress will enact an effective solution to climate change. Viewed through a different prism, however, the resolution is an indication that sensible carbon pricing is picking up steam, putting opponents on the defensive.

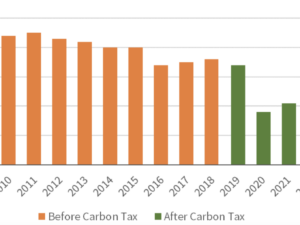

The wording of the resolution, introduced by Rep. Steve Scalise (R-LA), makes it clear that there was no consideration for a revenue-neutral carbon tax such as CCL’s Carbon Fee and Dividend proposal. CCL Legislative Director Danny Richter wrote a point-by-point response to the resolution detailing how our proposal differs from the kind of carbon tax assailed in the resolution.

One of those points and CCL’s response:

Whereas American families will be harmed the most from a carbon tax;

On the contrary, there is good reason to be certain that this will not happen and that a majority of American families will benefit from pricing carbon. The Household Impacts study found that 53 percent of households, and 58 percent of individuals, were made financially better off with the policy. The reason for the difference is that households with children benefit a bit more from the dividend formula CCL advocates for.

Earlier in the week, CCL volunteers who communicate with House staffers sent messages acknowledging the concerns raised in the resolution but pointing out that those concerns would be allayed with a carbon fee that returns revenue to households.

Nevertheless, the resolution passed mainly along partisan lines, putting most House Republicans on the record – symbolically, at least – in opposition to carbon taxes.

So, where is the silver lining in this vote, if there is one? Actually, there are a few.

First, momentum for pricing carbon has picked up enough steam that opponents of climate action felt compelled to bring Scalise’s resolution, which was introduced last fall, up for a floor vote. Amanda Reilly from E&E Daily reported Thursday:

In a floor speech yesterday, Rep. Jared Polis (D-Colo.) said that the idea of a carbon tax has momentum and that he believed the debate and vote on the resolution would move the discussion forward in Congress.

“Honestly,” Polis said, “this is the first sign of momentum for a carbon tax cut — and you’ll hear me referring to it as a carbon tax cut because that’s essentially what it is: using carbon tax revenues to cut taxes for the American people.”

“You don’t see these kinds of resolutions if a concept and an idea doesn’t have momentum,” Polis added.

CCL’s Danny Richter offered this assessment:

“The first Scalise carbon tax amendment passed the House on Aug 2, 2013. It had 155 co-sponsors. Today’s Scalise amendment had only 82 co-sponsors, and rumor has it that the leadership was strongly going after its membership to vote with the party. The fact that the vote took place two days after originally scheduled may support that. So what I see is a recycled idea with less support and on which the party leadership is having to work harder to enforce the party line.

“Given that the vast majority of House Republicans are already on record as having voted for this non-binding resolution, today’s vote doesn’t much change the problem we already had in terms of accusations of flip-flopping. The language of Scalise, by completely ignoring the case of a revenue-neutral carbon fee, is easily countered by existing statements from conservative economists. In short, while annoying, I don’t see this vote as a problem we didn’t already have, nor do I see it as remotely insurmountable.”

Conservative supporters of a revenue-neutral tax expressed similar views. From E&E:

Catrina Rorke, director of energy policy at the R Street Institute, said yesterday that the resolution was mostly a product of the contentious politics around climate change but that it signaled that efforts to sway more conservatives to rally around a carbon tax were having an effect…

“We’re having some traction, so that’s why the politics are rearing their ugly head this week with a vote on the House floor,” she said.

R Street was among a coalition of conservative organizations that last week sent a letter to members of Congress responding to the resolution. Here’s an excerpt:

“An economy-wide carbon tax that replaces existing regulatory interventions could reduce the cost of climate policy and deregulate the economy. It could also provide revenue to support pro-growth tax reform, including corporate income or payroll tax cuts, which could dramatically reduce overall costs on the economy. Revenues could be applied to compensate those who suffer the most from higher energy costs; the poor, the elderly, and individuals and families living on fixed incomes.

“Unfortunately, none of those options are presently available because Members of Congress have neglected opportunities to design and debate market-friendly climate policies in legislation. Instead, they have yielded authority in climate policy design to the Executive Branch. By discouraging a long-overdue discussion about sensible carbon pricing, this resolution frustrates the development of better policy.”

Another silver lining is that 15 Republicans abstained from voting or voted “present,” which is pretty amazing considering all the arm twisting from leadership. For whatever reason, these Republicans made a decision to keep their options open on climate policy.

CCL’s lobby day on June 21st, when more than 800 volunteers from around the nation will meet with nearly all House and Senate offices, comes at a perfect time to dispel the misconception that all carbon taxes are bad for the economy.

“To be sure, this was not the finest hour for the House of Representatives,” said CCL Executive Director Mark Reynolds. “But it provides the opportunity for our volunteers to educate members of Congress about the benefits of a carbon fee with revenue returned to households. Our work ahead is pretty clear.”