The AES coal plant near Kalealoa, Oahu (Tony Webster/Creative Commons)

How economists support the fight for a carbon fee and dividend in Hawaii

By Jonathan Marshall

Since 2019, an exciting drive to enact a statewide carbon fee and dividend has played out in Hawaii. CCL volunteers have been at the forefront of that ongoing effort along with another non-profit called Faith Action and the state’s Environmental Legislative Caucus.

The most recent carbon fee and dividend bill sailed through Hawaii’s House on a 46-3 vote earlier this year, only to get blocked in the Senate, which declined to give it a hearing given the unsettled state of world energy markets. Ironically, two years ago the state Senate passed a $40 carbon fee and dividend bill 23-2, only to have it get stuck in the House.

One sticking point in 2020 was the desire of legislators to wait for the results of a University of Hawaii (UH) study on how a carbon fee would impact the state’s emissions, economy, and household incomes. The legislature had funded it in 2019, but the governor did not release the study until 2021, missing key vote deadlines. However, the study did persuade skeptical legislators in the House to approve a carbon fee and dividend bill overwhelmingly this year.

Reflecting the quality of the UH team’s work, a full report on its underlying model and results has recently been published in the peer-reviewed journal Climate Policy. One of the five co-authors is economist and CCL volunteer Paul Bernstein. I’ve known Paul for a couple of years through our joint participation in CCL’s Economic Policy Network action team.

After graduating from Stanford with his Ph.D. in operations research in 1996, Paul worked for two national economics consulting firms with strong practices in the energy sector. Since 2005, he has also worked part-time for UH. UH has undertaken research for state agencies on topics such as the viability of a major wind energy project, forecasting EV market penetration, and helping the city of Honolulu draft a climate action plan. Paul joined colleagues at UH on the carbon tax study for the Hawaii State Energy Office.

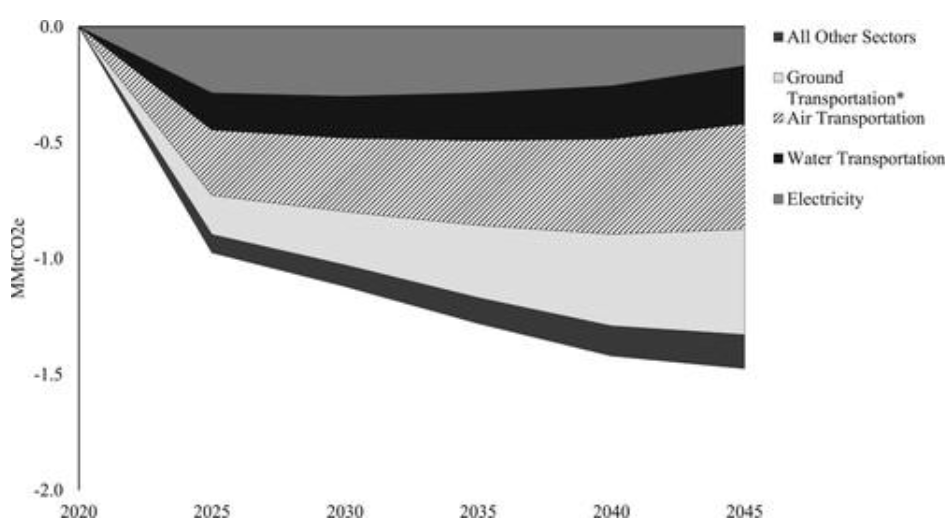

The study is a notable addition to the sparse literature on the impacts of carbon pricing at the state rather than the national level. Unlike many studies, which fail to account for complex feedback effects, the UH team used a more sophisticated Computable General Equilibrium Model to assess the impacts of a carbon tax on Hawaii’s economy, industries, and households. It specifically simulated a tax starting at $56 per metric ton of CO2 in 2025 and rising slowly to $79 by 2045. The team chose $56 as the federal estimate for the “social cost of carbon” reached by the Obama administration and endorsed by the Biden administration.

The results of the study were as notable as its methodology:

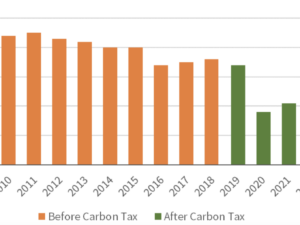

- The carbon tax would reduce emissions by a third more than existing state climate policies, which include a mandate for generating all electricity from renewable energy by 2045.

- Total state GDP would shrink a microscopic 0.6% by 2045 relative to the baseline.

- For households, combining the tax with an equal dividend would result in net welfare gains for all income groups, especially the lowest income groups. That’s a better result than forecast by any model of a national carbon fee and dividend. The secret: a significant portion of the tax would be paid by affluent visitors to the islands rather than residents.

Change in Hawaii’s GHG Emissions from the Baseline by Sector with a $56+ Carbon Tax

Source: Makena Coffman, et al., “Economic and GHG impacts of a US state-level carbon tax: the case of Hawai‘i,” Climate Policy, epub, April 10, 2022.

Results of the study made their way into the very first paragraph of Hawaii’s carbon tax bill this year. After noting the international success of carbon taxes, and the support they have won from “eminent economists,” the bill cited the UH study as finding that a “carbon tax and dividend policy . . . would substantially reduce the consumption of fossil fuels, while financially benefiting most Hawaii households.”

Next steps for carbon pricing in Hawaii

Given the study’s highly favorable results, and mixed but promising votes in both state chambers, carbon tax legislation still has a chance of being enacted in Hawaii once the panic over soaring oil prices subsides.

Paul vows, “We aren’t giving up.” He and other citizen lobbyists hope their efforts will also inspire national politicians to promote carbon fee and dividend legislation to cover the United States—a goal shared by Hawaii’s Sen. Brian Schatz and Rep. Kai Kahele.

Jonathan Marshall is Economics Research Coordinator for Citizens’ Climate Education and former Economics Editor of the San Francisco Chronicle.