New study: CFD much better for economy, households than regulations

By Jerry Hinkle

A number of climate policy proposals were offered by Democrats in 2020 that would achieve CCL’s primary objectives1 through a predominantly regulatory approach to reducing emissions. However, CCL has chosen to continue focusing our advocacy on a national carbon price. Though these policies can play an important complementary role in a comprehensive climate package, we continue to advocate for a carbon tax as the backbone of an ambitious US climate policy. As explained in this National Conference presentation (start at minute 37), the primary reasons for this are that carbon fee and dividend (CFD) is better for the economy, better for the poor, and will reduce emissions more quickly. It is also more likely to achieve bipartisan support, a feature which is essential for policy durability.

Regarding it being better for the economy, a study has just been published that explicitly quantifies the difference in economic impacts of a CFD approach versus a purely regulatory approach to reducing emissions. The analysis, produced for the Climate Leadership Council (CLC), compares the impact on GDP and household consumption from a CFD policy starting at $43/ton2 and increasing at 5% per year3 , and a regulatory policy consisting largely of clean energy, energy efficiency and fuel efficiency standards that generate the same level of emission reductions. The CFD policy presented in this paper is referred to specifically as the “Carbon Dividends Plan,” or CDP.

Study Results

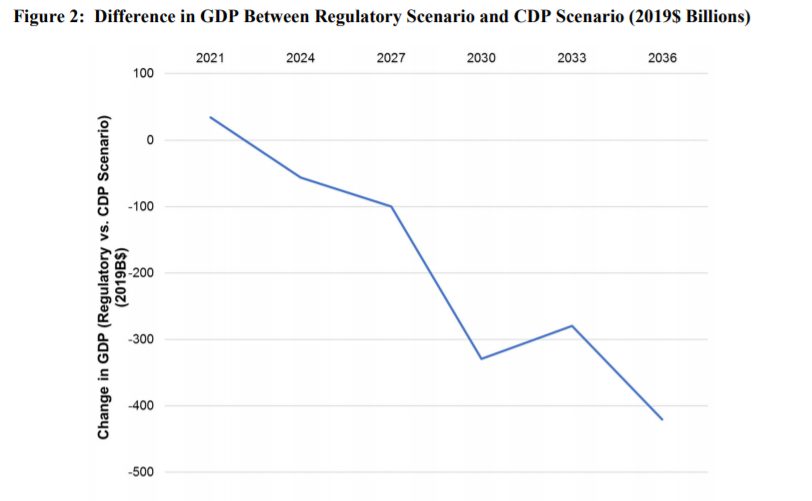

The fundamental result of the study, completely consistent with the economic literature (pgs. 12-18), is that a scheduled carbon price reduces emissions at far less economic cost than a standard regulatory approach. Specifically, the GDP advantage in the CDP scenario over the regulatory plan steadily increases to reach $420 billion dollars in the final year of the study, 2036. This represents 1.5% of GDP in that year, and this economic advantage is expected to grow over time.

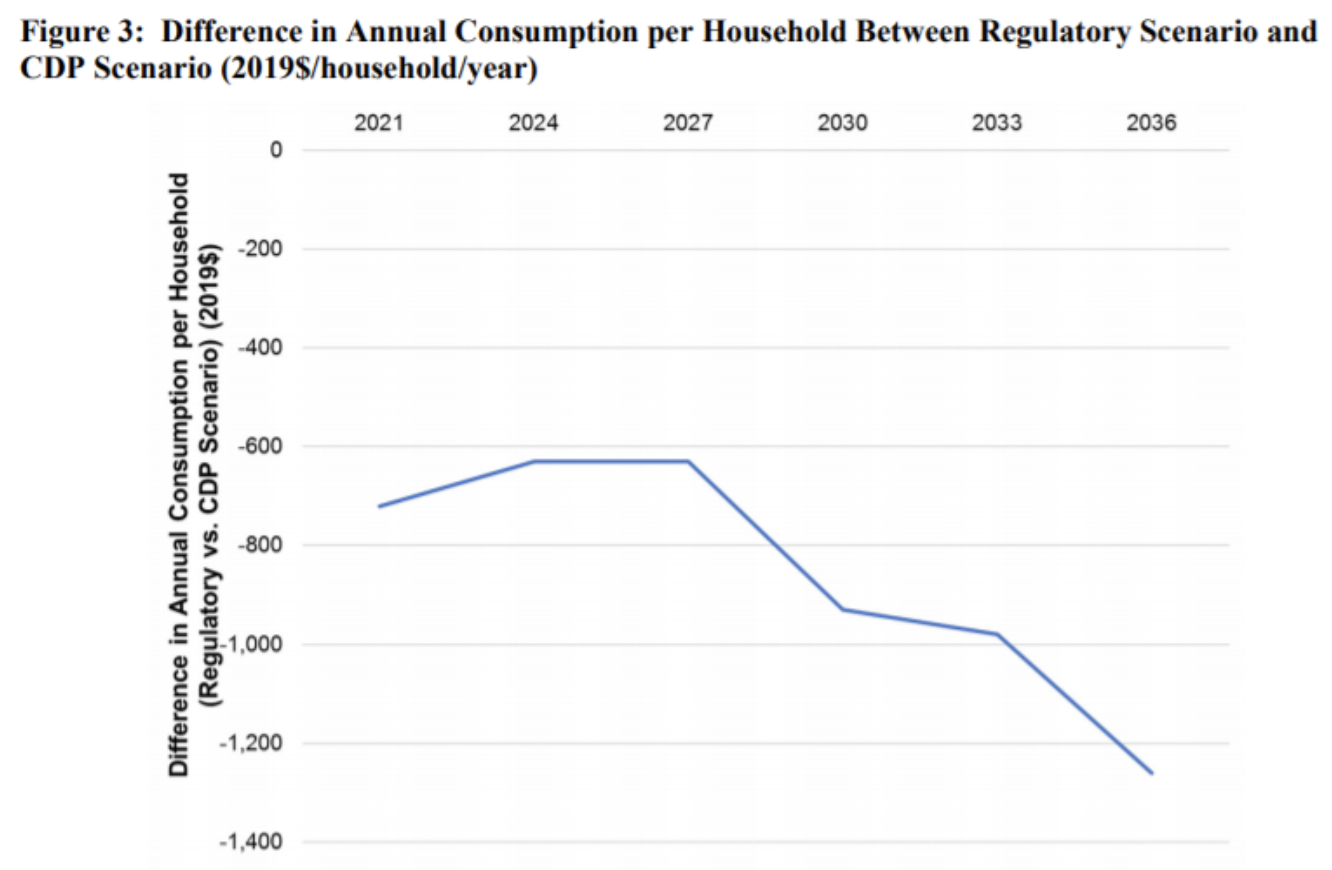

This economic cost advantage is also estimated in terms of household consumption per year (see graphic, below). Again, CFD results in greater consumption, and the difference increases over time to reach an average of $1,260 per household by 2036. This advantage would also continue to increase over time.

The study points to an additional advantage of a carbon price that was illuminated in a recent CCL Blog. A border carbon adjustment (BCA) can be coupled with an explicit carbon tax under WTO rules to protect the competitiveness of US producers and the jobs they create. In contrast, though a regulatory approach would raise costs on producers by, for example, raising energy costs, a BCA would almost certainly not be allowed under WTO rules in that case. Without a BCA, the US competitiveness of exporters would suffer and corresponding jobs would decline. This would further diminish the political appeal of a regulatory approach to emission reductions.

Why Regulations Cost More

A carbon price provides a consistent financial incentive across the economy to reduce emissions. Businesses and consumers have complete flexibility make reductions in a least-cost manner. In contrast, regulations tend to stipulate how to reduce emissions and when, and this may not be consistent with a “least-cost” approach. For example, a CAFÉ standard requires producers to sell more fuel-efficient cars. In contrast, a gas tax directly incents all to reduce emissions in a least-cost manner, so driving less and taking public transportation are also options. As a result, the same level of reductions are achieved at a fraction of the cost (see page 13). Similarly, a clean energy standard in the power sector does not provide the same consistent financial incentive to reduce energy use as a carbon tax does, so achieving the same level of reductions costs more (see page 15).

Summary Implications

At CCL, we trumpet peer-reviewed research that indicates revenue neutral carbon tax policies (like the Energy Innovation and Carbon Dividend Act) have “roughly zero impacts on the overall growth of the US economy,” so that the enormous climate and health benefits from the policy come at little to no economic cost. Though certain regulations can have a complementary role to play in reducing US emissions consistent with science-based targets, if we relied on regulations for the bulk of the reductions, the economic cost of the policy would be significantly higher. This study makes that clear. The incoming Congress may yield a wide range of climate proposals, and some may meet CCL’s primary objectives. During this period, imposing a predictable carbon price will remain the focus of our advocacy as the policy that, overall, is best for the economy and households.

Footnotes:

1. CCL’s primary objectives for climate policy is that it greatly reduces emissions while not harming the bottom two income quintiles.

2. The fee starts at $40/ton in 2017 dollars, or $43/ton in current dollars.

3. There are two key differences between the CFD policy simulated and HR 763 for purposes of the modeling exercise. First, this carbon price starts higher ($43) but grows more slowly (5%), so that it reaches $94 by 2036 whereas HR 763 reaches $165 in 2036 if it begins in 2021. Second, this proposal gives a full dividend share to all those under the age of 19, whereas HR 763 gives them a half share. The two policies are sufficiently similar, and the analysis results sufficiently strong, that the conclusions drawn from this study can be assumed to apply to HR 763 advocacy.

Jerry Hinkle is a research coordinator for CCL.