House passes budget bill cutting clean energy tax credits

By Flannery Winchester and Ricky Bradley

On May 22, the House of Representatives passed its version of the budget reconciliation bill, which dramatically slashes America’s clean energy tax credits. As CCL’s Executive Director Rachel Kerestes expressed in a statement, we are deeply disappointed to see this result.

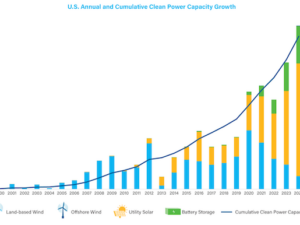

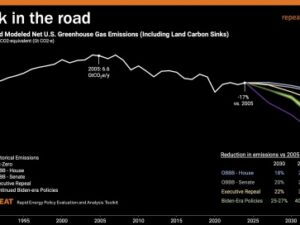

The initial cuts to the clean energy tax credits proposed by the Ways and Means Committee last week were bad enough, with a Rhodium analysis estimating they would “raise energy costs for American households by as much as 7% in 2035, stifle energy technology innovation, increase pollution, and could put a meaningful portion of half a trillion dollars of new manufacturing, industrial, and clean electricity investments across the country at risk.”

But overnight on the House floor, the legislation was amended further — in the wrong direction. “For the clean electricity subsidies, the revised text nixes the previously proposed three-year phase-down schedule and bluntly cuts off any project that doesn’t break ground within 60 days of the bill’s passage,” Heatmap reports.

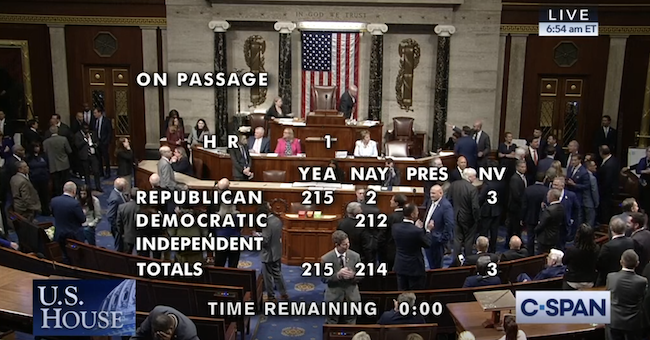

Ultimately, the bill squeaked by on Thursday morning with a vote of 215 to 214. Nearly every House Republican ultimately voted with their party, including every House Republican who had indicated some support of the tax credits over the last few weeks and months.

This is a tough moment. Over the last six months, CCL volunteers have been hard at work conveying to Congress the importance of clean energy tax credits, from dozens of in-person lobby meetings and personal letter drop-offs, to thousands of messages and phone calls, all directed at Republican offices.

We’ve also spent years pouring heart and soul into building respectful relationships on both sides of the aisle for climate policies. We believe, still, that nonpartisan engagement with Congress and our steady presence — what CCL’s founder Marshall Saunders called “constancy” — will yield long-term gains.

And even though our efforts didn’t stop this vote, this vote is not the whole story. Many Republicans have changed how they talk about climate and clean energy, in part because of the persistent, values-based engagement from CCL volunteers. That doesn’t always translate into immediate votes, especially in the face of overwhelming partisan pressure exerted during a process like budget reconciliation, but it does shift the terrain for the future. That’s how cultural and political change happens: slowly, then suddenly.

We are proud of our work and grateful to every grassroots volunteer who has put time and effort toward the specific defense of clean energy tax credits and toward the broader, long term work of CCL. And we’re not done yet.

Time to sway the Senate

House passage is not the finish line for this legislation. The bill is now headed to the Senate, where Senators will have to craft and pass their own version of the bill. Ultimately, both chambers of Congress will have to pass the same version in order for it to become law.

Over the last few weeks, CCL’s volunteer liaisons have already been holding meetings with Senate Finance Committee members, emphasizing the benefits of these clean energy tax credits and laying groundwork for their protection.

Now, the full effort of our grassroots network will focus on urging every Senator to hold the line. We’re asking them to reject these aggressive rollbacks from the House and preserve the tax credits — and their benefits — in their bill.

Use our updated action tool to send a message to your Senator now.

And we plan to get loud in local media too, with a new op-ed template available now and a special media workshop coming up next week.

Because this is what we do here at CCL: We act. We are the kind of organization that people want to be part of because we stay grounded when things get hard. We don’t inspire others by pretending things are easy; we inspire them by recognizing that it’s hard and showing up anyway. We speak truthfully, invite people into meaningful work, and keep the door open to everyone who wants to engage in good faith.

This House vote is a disappointing development, but budget reconciliation can be a long and often surprising process. We aim to defend the clean energy tax credits at every step of the way, and with new and creative tools. Let’s keep at it.