Many Americans don’t think much about Canada, other than their awareness that it’s a big non-threatening country to the north that gets really cold in the winter, but has some great fishing. But Canada definitely punches above its weight in some areas, whether it’s producing rock stars, comedians, or – of course – hockey players. Less visible is Canada’s leadership in one vital area of climate policy: putting a price on carbon.

Economic models of carbon pricing with household dividends have shown it to be economically beneficial, despite baseless claims to the contrary, and now its viability has been confirmed by real-world evidence. Other countries have implemented various forms of carbon pricing, but Canada, the largest importer of American goods, is the one that has successfully implemented nationwide carbon pricing featuring rebates to households, much like the Energy Innovation and Carbon Dividend Act that CCL supports in the U.S.

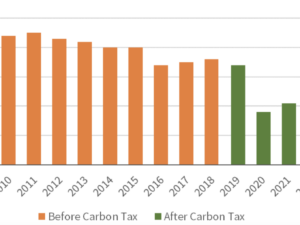

This all started with the Canadian province of British Columbia, which took the carbon tax plunge in 2008. By 2019, as their carbon price went from $10 to $40 per ton of CO2, carbon emissions per person went down 12%, twice as fast as the nation as a whole. That policy recycled the revenue in the form of cuts to personal and corporate income taxes, low-income tax credits, and a property tax reduction for northern and rural homeowners.

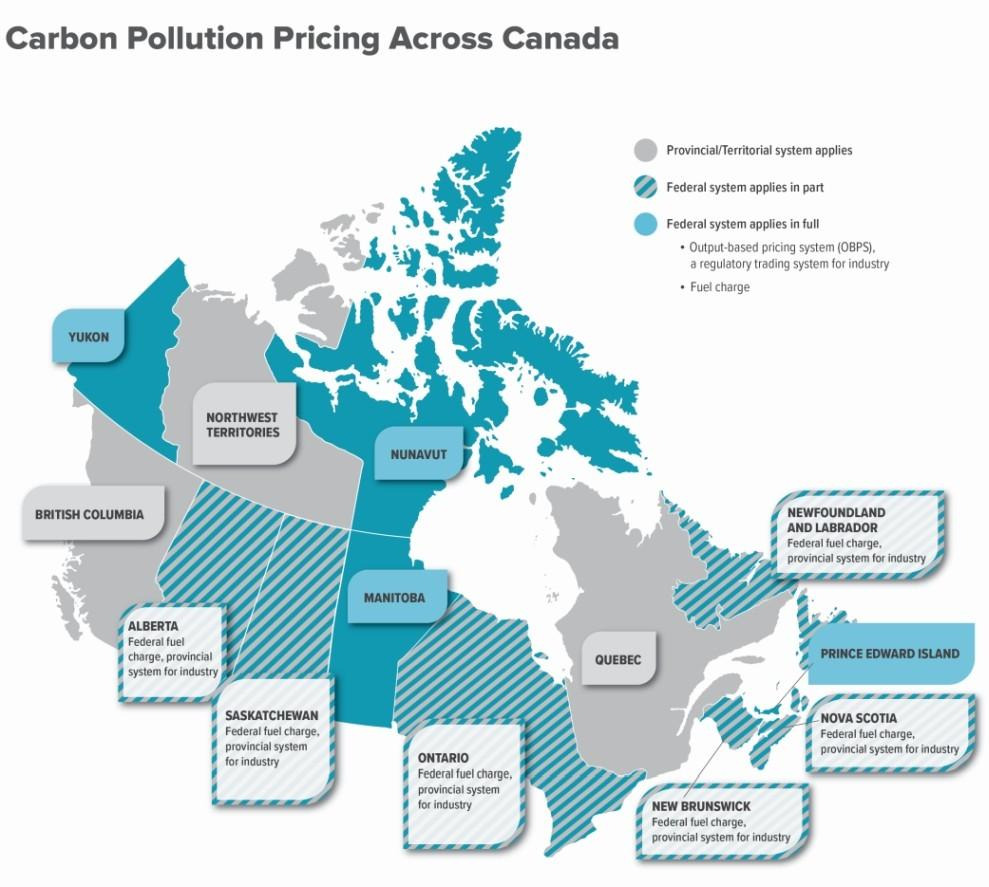

Encouraged by that success and by public support of BC’s carbon pricing, the Canadian federal government followed suit in 2018, instituting a requirement for provinces to either adopt a strong climate policy of their own or accept a “backstop” federal carbon tax, technically known as the fuel charge.

That carbon tax applies to 22 different forms of fossil fuel, some of which (e.g., “high heat value coal”) are used directly by industry and others (e.g., gasoline) are sold to consumers. The price basis is C$65 per ton of CO2-equivalent in 2023 and will increase by C$15 per ton each year until it hits C$170 in 2030. The Canadian climate plan also employs an output-based pricing system for industrial emissions that is essentially a cap-and-trade system intended to function much like a border adjustment.

As of July 2023, 10 of the 13 Canadian provinces and territories have adopted the federal fuel charge, while three have a federally-approved separate system. One of those latter three is British Columbia, which maintains its first-in-the-nation carbon tax. Another is Quebec, which has joined California’s cap-and-trade system. And the Northwest Territories administers its own carbon tax.

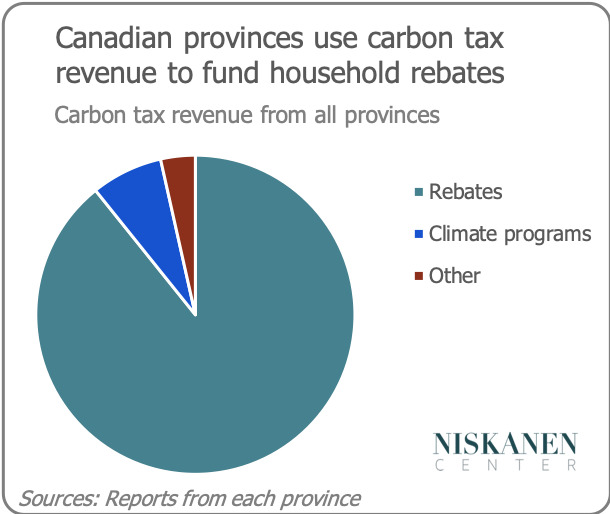

So for all practical purposes, all of Canada except for Quebec has boarded the carbon tax train, and in all of those jurisdictions, a major portion of the revenue is returned to households such that, according to the Niskanen Center, 80% of families come out ahead.

What lessons can we learn from the carbon pricing story from our northern neighbor? Some may think that because Canada is regarded by Americans as more politically moderate, getting a carbon tax in place must have been a breeze. But that’s far from the truth. Listen to this interview with two prominent Canadian officials, Gerald Butts and Catherine McKenna, to get the full story.

Their experience underscored the political importance of how the revenue was to be used, with the added twist of allocating all the money collected in a province back to that same province. Certainly the 90% household rebate was also a crucial piece in getting public support.

But another thing that stands out to me is the fact that these two carbon pricing proponents were key members of the Prime Minister’s cabinet, and had other allies in the cabinet. In the U.S. context – which differs significantly from Canada’s parliamentary system – the analogous scenario would be the presence of strong allies among House and Senate leaders (and/or their staffs) and the White House.

In a nutshell: Canada, the largest importer of American goods, has enacted a national carbon tax with household rebates that applies to 77% of the population. For the remaining 23% of Canadians, their economy is also subject to carbon pricing, but under a cap-and-trade system connected to California’s. So, carbon pricing of one kind or another is universal in Canada.

Unfortunately, the interview did not touch on the vital role that CCL Canada played in drumming up Parliamentary support for the policy and especially for the dividend. But that’s okay because we know how important our people have been in making this happen.

The Canadian carbon pricing system has been in place now for five years, and their economy has continued to thrive while 80% of Canadians receive more in climate action incentives than they pay in excess energy costs. The policy has survived multiple election cycles, but it took – and continues to require – iron determination, careful negotiations within the governing coalition, and unrelenting advocacy from organizations like CCL.

If it worked there, it can work here.