Climate change and insurance

by Elissa Tennant

Most people tend to think about climate change in terms of environmental damage or public health risks, but there’s another, often overlooked issue: insurance costs.

Seven percent of Americans don’t think global warming is happening, but their insurance company certainly does! Climate change and insurance costs are interlinked. As wildfires, hurricanes, hailstorms, and other disasters grow in severity and scope, insurers are rethinking how, where, and if they offer coverage.

The Rising Costs of Home Insurance

Extreme weather events are becoming more frequent, intense, and expensive. The destruction from these events translates into more frequent insurance claims—and more expensive insurance claims. As carbon pollution fills our atmosphere, risks of weather-related property damage increase and people seek financial help from insurers to cover the rising costs.

However, the current insurance industry business model is predicated on a modest rate of disasters that simply doesn’t exist anymore. The high costs of new and increased disasters are threatening to put insurers out of business or force them to reduce services. Basically, insurance companies can’t keep up anymore.

In 2023 alone, property and casualty losses from catastrophic events in the U.S. totaled an estimated $65 billion. In 2024, NOAA tracked 28 separate weather disasters that each caused over $1 billion in damages. As a result, insurance companies are paying out more than ever before, and that’s triggering a ripple effect across the industry.

To manage their mounting risk, insurers are raising premiums significantly. Between 2021 and 2024, homeowners insurance rates rose 27% nationally. In high-risk areas, rates have climbed even higher. In some cases, homeowners are seeing their premiums double or triple over just a few years, rising much faster even than inflation. The state of California recently gave State Farm permission to raise rates 17% in the wake of the 2025 wildfires.

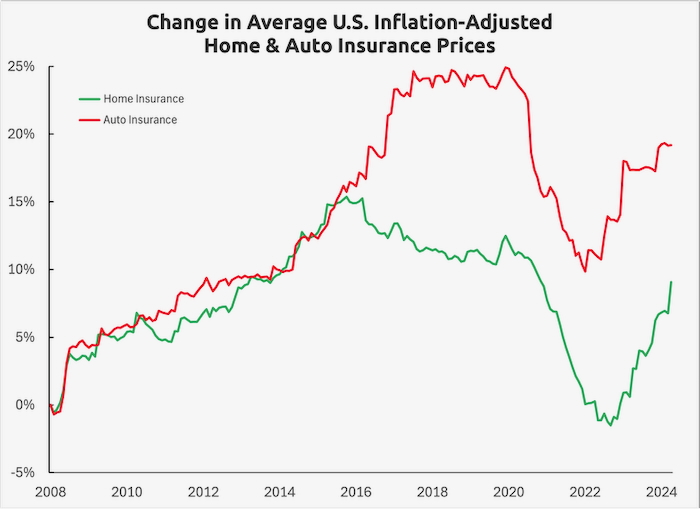

How much faster than inflation average U.S. home (green) and automobile (red) insurance premiums have risen from 2008 through 2024. (Insurance premium data: Federal Reserve Bank of St. Louis. Graphic: Dana Nuccitelli.

Climate change isn’t just bringing higher premiums. States that are exposed to more natural disasters experience high insurance rates and low housing values, further exacerbating America’s affordable housing issues. And in some areas, private insurers are simply backing out, leaving people with little to no insurance options. Potential buyers can’t even get a mortgage without insurance.

According to Cliff Rossi, professor at the University of Maryland and financial risk expert, “In many places of the country, we’re finding that large insurance companies are pulling out altogether, like in California and Florida, as a result of either wildfires that have happened and are raging in those states, or flooding in other states. It’s a huge issue, and I think it’s the next crisis that we’re going to see in housing within the next five to 10 years, easily.”

Insurance increases have left many homeowners scrambling. Some can’t find any private insurer willing to cover their homes. Others are forced to settle for limited, high-deductible policies that offer less protection at a higher cost.

Government’s Role in the Insurance Market

When private insurers back away, the government often steps in. Federal and state governments have attempted to solve the problems created by climate change and insurance prices. Programs like the National Flood Insurance Program (NFIP), managed by FEMA, offer coverage for homes in flood-prone areas. But the NFIP has long been criticized for outdated flood maps, low caps on payouts, and rising premiums of its own. It’s also billions of dollars in debt, due in part to the frequency and severity of recent storms.

Some states have also created their own insurance programs. In Florida and California, state-run “insurer of last resort” programs are now covering more properties than ever before. But these programs are often underfunded and vulnerable to collapse in the face of a truly catastrophic event. They also face similar criticisms to the NFIP program.

Government action can’t solve this problem alone. As climate change escalates, it’s clear that both private and public insurance systems are struggling to keep up.

The Future of Home Insurance in a Changing Climate

Looking ahead, the insurance industry is likely to make big changes in response to climate risks. Some companies are already moving toward climate-focused underwriting practices that take into account not just a property’s location, but its resilience to extreme weather. That could mean higher deductibles for homes in risky areas, stricter coverage limits, or incentives for homes built with fire-resistant or flood-proof materials.

Homeowners, too, will have to adapt. That may mean investing in structural upgrades (like storm shutters, raised foundations, or fire- and hail-resistant roofs) to qualify for insurance or reduce costs. In some cases, it could even mean moving away from high-risk areas entirely. The idea of “climate migration” is being taken seriously by insurance companies, real estate professionals, and policymakers alike.

What Can We Do?

It’s clear climate change is impacting us today, but our communities are not equipped to withstand the consequences. Insurers, governments, and homeowners all have a role to play in solving the problem and taking climate action.

In the short term, we need disaster relief programs, storm-proof houses, and affordable insurance options. But beyond adapting to immediate climate impacts, we must also address the long-term problem: climate change itself. By advocating for climate change solutions now, we can minimize long-term impacts.

We can’t control the weather, but we can control how we respond to it. That means preparing our communities for climate risks and reducing the emissions driving those risks. The future of climate change and insurance (and the security of American families) depends on it.

Here’s what you can do right now:

✅ Talk to your friends and family about climate change

✅ Electrify your home with clean energy