CCL Research Coordinator Dana Nuccitelli breaks down the climate provisions of this legislation and the data you need to know to defend it from repeal.

Data to defend the IRA

By Dana Nuccitelli, CCL Research Coordinator

It’s a new year, with a new Congress, and the Inflation Reduction Act (IRA) is on the chopping block — and not just because President Trump signed an executive order pausing IRA funding as one of his first moves in office. The IRA is at risk because Republicans in Congress are looking for ways to pay for the extension of tax cuts they passed last time they controlled the White House and majorities in Congress, in 2017.

In our December virtual lobbying, CCL volunteers with Republican representatives advocated for the preservation of the IRA’s climate provisions, which represent America’s biggest-ever effort to curb our climate pollution. At the time our ask was very general because it was too early to go into specifics. The new Congress hadn’t even taken office yet.

But now we’re ready to arm ourselves with the data necessary to make our efforts to preserve the IRA’s climate provisions as effective as possible.

I gave a Citizens’ Climate University training to educate CCL volunteers about this important topic and data. Watch the full training here or read on for a recap.

What’s in the IRA

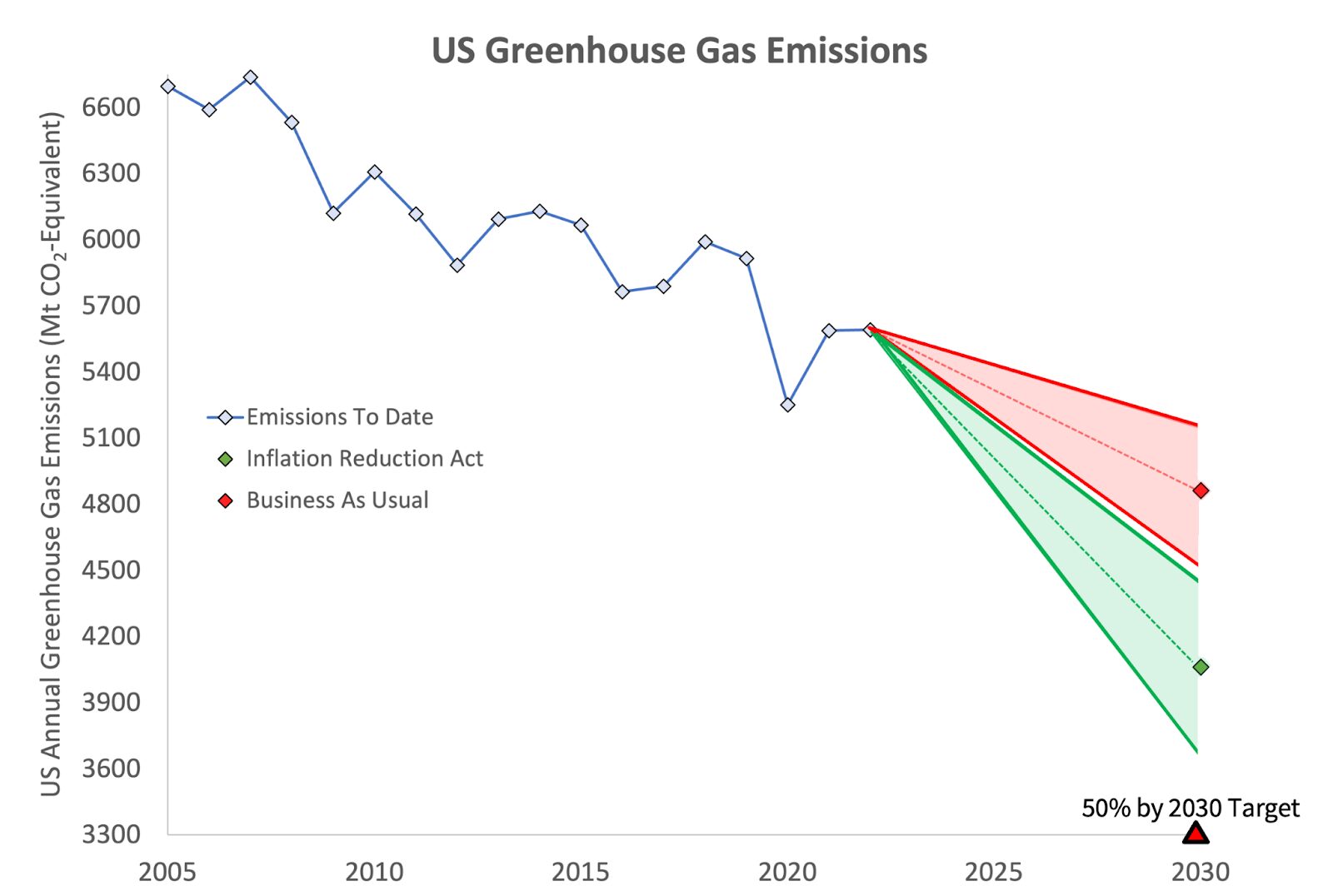

Before the IRA passed, the U.S. was on track to fall about halfway short of our Paris climate commitments. The climate provisions in the IRA cut that gap in half:

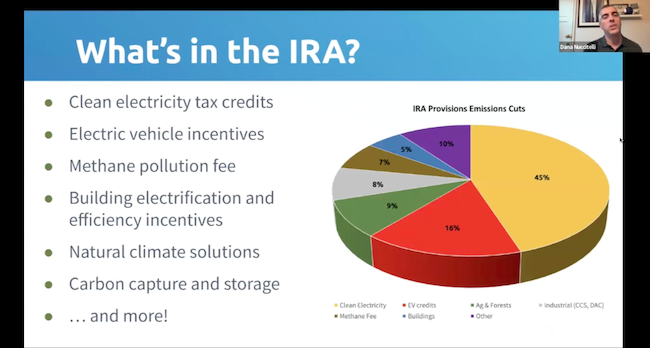

And so we want to preserve as many of those IRA climate provisions and pollution cuts as possible. They include:

- Clean electricity tax credits

- Electric vehicle incentives

- Methane pollution fee

- Building electrification and efficiency incentives

- Natural climate solutions

- Carbon capture and storage

… and more! See our new Data to Defend the IRA training page for further information.

The new political climate

Extending all of the tax cuts in the 2017 Tax Cuts and Jobs act would cost around $4 trillion. Many congressional Republicans don’t want to add trillions more dollars to the national debt, which already exceeds $36 trillion, and so they’re looking for ways to pay for those tax cut extensions. That’s the motivation behind proposals to repeal the IRA, which has a total price tag close to $1 trillion.

But IRA-funded projects have created a tremendous amount of investments and manufacturing jobs, especially in districts represented by Republican members of Congress. That’s because big facilities like solar and wind farms and manufacturing plants require a big chunk of available, affordable land, often in rural areas, whose residents tend to vote for Republicans. And Republican-led states also tend to offer generous state and local tax incentives to encourage business development.

And many congressional Republicans have said that we should keep some particularly beneficial IRA clean energy provisions. Even Speaker Mike Johnson said, “You’ve got to use a scalpel and not a sledgehammer, because there’s a few provisions in there that have helped overall.” We at CCL want to use our evidence-based lobbying efforts to help guide that scalpel away from the most important climate provisions.

Which IRA provisions are most important for the climate?

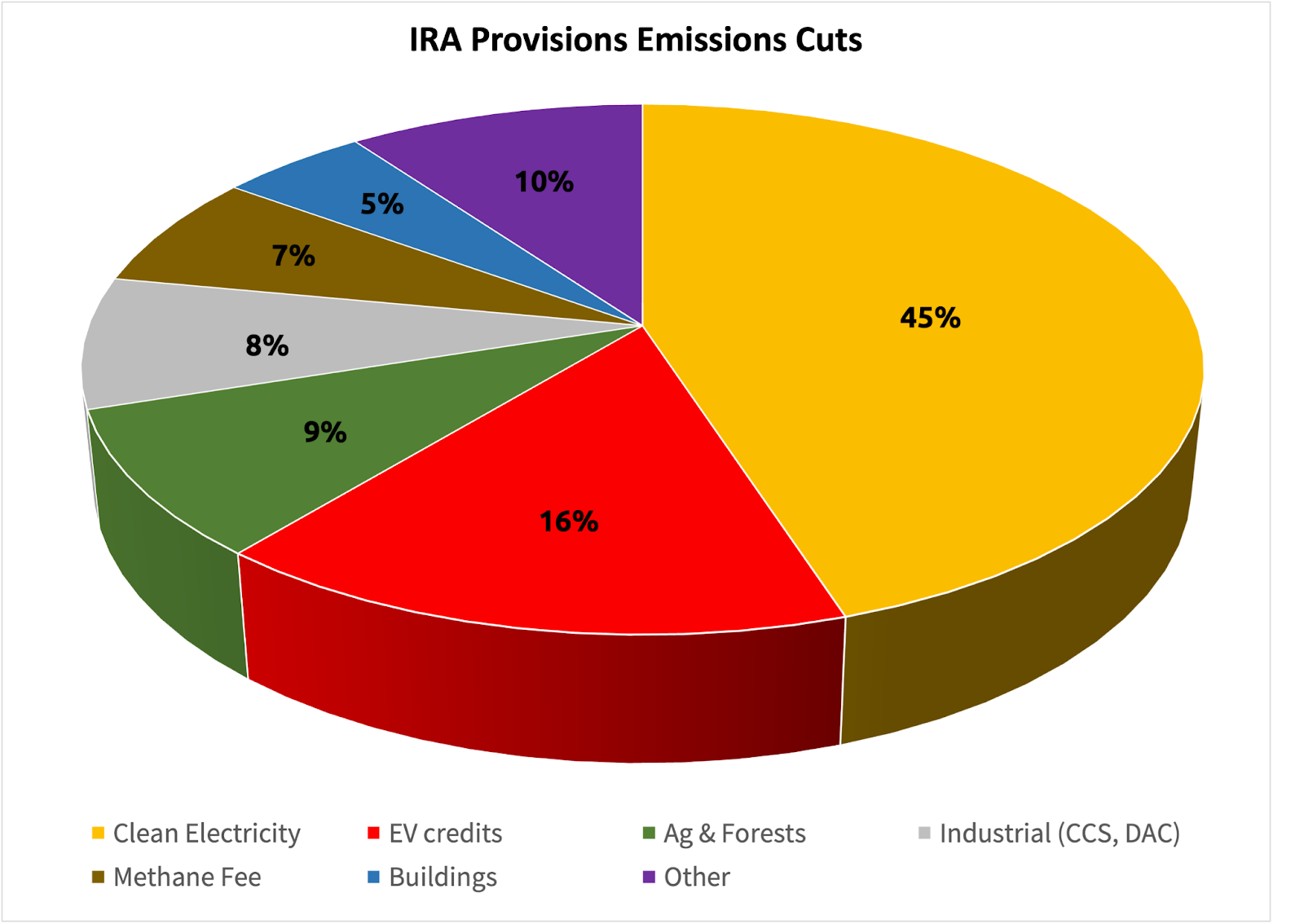

I created the pie chart below based on several IRA modeling efforts, including from Rhodium and Princeton:

The clean electricity tax credits are the most important IRA provisions for the climate, responsible for about half of the bill’s potential climate pollution cuts. A recent analysis estimated that repealing them would also raise Americans’ electricity bills in 2040 by about 10%.

The electric vehicle (EV) tax credits are the next-most important. They’re not as effective as the clean electricity tax credits, but would nevertheless significantly reduce US climate pollution by boosting EV sales about 20% between now and 2035. These tax credits are also responsible for the vast majority of IRA-funded projects, investments, and jobs, especially in Republican-represented congressional districts.

The methane pollution fee could help reduce emissions from the oil and gas industry. And unlike the tax credits, repealing it wouldn’t help pay for tax cut extensions. But small oil and gas companies are lobbying hard against the methane fee because they don’t want to be forced to incur the cost and effort to fix their methane leaks.

Some other important IRA components include incentives for home electrification and efficiency, funding for climate-smart agriculture, and credits for industrial carbon capture and storage. For more information about all of these provisions, see the training page and video.

The CCL Research team also created a database of IRA-funded projects by state and congressional district, which will provide useful data for grassroots and grasstops lobbying efforts. Check out the database at cclusa.org/defend-IRA-data and make sure you know the local benefits in your area.