IRA repeal would have four really bad consequences

By Dana Nuccitelli, CCL Research Manager

Now that a bit of time has passed since the House passed its big budget bill that would largely gut the Inflation Reduction Act’s clean energy tax credits, a number of research groups have assessed the impacts and consequences that would result from passing the bill. In a word, they would be bad. Really bad.

Three organizations (Princeton REPEAT, Energy Innovation, and Rhodium Group) evaluated the impacts of the entire budget bill, while five others (Aurora Energy Research, Resources for the Future, Brattle Group, National Economic Research Associates, and Solar Energy Industries Association) looked specifically at the repeal of the clean electricity tax credits that have been a focus of CCL’s advocacy.

I’ll group their findings into four categories below, and for more specific details about the findings of these reports, see this Nerd Corner post on CCL’s Community forums.

Editor’s note: On CCL’s June monthly meeting, Dana recapped the major impacts of repealing these tax credits. Watch the recording here, or read on for the major takeaways.

It’s effectively an electricity and gas tax

If the IRA’s clean electricity tax credits are repealed, fewer clean energy projects will financially pencil out and be built. That means less clean and cheap power sources will be deployed at a time when electricity demand is expected to rise fast due to rapidly expanding data centers, artificial intelligence, electrification of vehicles and buildings, and air conditioning use as temperatures rise.

And as the law of supply and demand tells us, if demand goes up faster than supply can meet it, prices will increase as a result. The reports estimate that repealing the IRA’s clean electricity tax credits will result in annual American household electricity bills becoming more expensive, by between $46 and $160 over the next decade.

But it’s not just electricity prices that will rise. If fewer clean energy sources are deployed, utilities will have to burn more natural gas to meet rising power demand. The law of supply and demand again tells us that this will make natural gas prices rise, by an estimated 2–7%. That will contribute to higher home heating and cooking bills for households with gas appliances.

Repealing the electric vehicle tax credits will also result in tens of millions fewer EVs on American roads in the 2030s. That means more demand for gasoline, which means higher prices at the pump. Resources for the Future estimates that gasoline prices will be about 10 cents per gallon more expensive than if the EV tax credits remain in place. And since fueling up an EV costs about $1,000 less per year than a gasoline car, tens of millions of Americans will miss out on those savings too. Overall, American household vehicle fueling costs would rise by an estimated $40 to $200 per year, on average, on top of the similarly higher electricity costs.

It would imperil American manufacturing, jobs, and economic growth

Hundreds of new clean energy projects have been announced since the IRA was signed into law, representing hundreds of thousands of jobs and hundreds of billions of dollars of investments in communities around the country. You can explore the investments in your state and district using CCL’s IRA projects database. As MIT and Rhodium’s Clean Investment Monitor illustrates, the vast majority of those investments have been in batteries, EVs, and solar panels.

Repealing the IRA’s clean electricity and EV tax credits would imperil many of these projects and their associated jobs and local economic benefits. The Princeton team estimated that if the EV tax credit were repealed, we may already have enough manufacturing capacity in place to meet the reduced American demand for EVs by 2030. We wouldn’t need to build any more domestic EV or battery manufacturing capacity, and companies might even have to reduce output and lay off workers from some of the factories that have already been built.

Without the clean electricity tax credits, there would also be less demand for US solar and battery and wind manufacturing, and fewer construction jobs building new clean power facilities. Overall, the experts estimate that hundreds of thousands of jobs would be lost throughout the US economy, and the country’s gross domestic product could decrease by more than $1 trillion as a result.

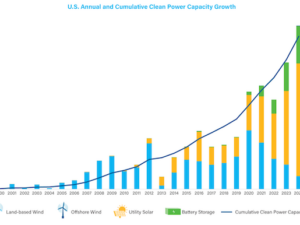

It would reduce our energy security

At a time when power demand is rising rapidly, natural gas turbines are facing years of delivery backlogs. Many experts have concluded that clean electricity – especially solar panels and batteries, which accounted for over 80% of new US electricity generation capacity added in 2024 – are the only sources that can be deployed fast enough to meet that rapidly growing demand. The less new power generation we build, the higher the risk not only of high electricity prices, but also of power outages and blackouts. Just look at Texas, which had no problem navigating a spring heatwave thanks to its high deployment of solar and batteries.

Experts estimate that US power demand will increase by 25–50% over the next decade, after rising by less than 10% over the previous two decades. Because of natural gas turbine backlogs, they won’t be able to meet more than one-third of the increased peak power demand. But the expert analyses find that repealing the tax credits would cut the amount of new clean power generation built over the next decade in half, putting Americans at greater risk of blackouts.

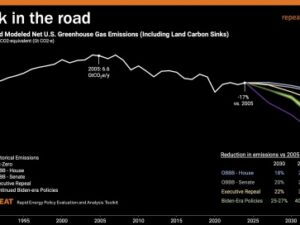

It would increase pollution and worsen Americans’ health

Repealing these investments in clean energy technologies would of course also increase both climate and air pollution. The reports estimate that doing so would leave US climate pollution just 20–30% below 2005 levels by 2030. Total emissions would be an estimated 1.5 to 3 billion tons higher over the next decade than if the IRA is protected. That’s equivalent to jamming an extra six months’ worth of US climate pollution into the next decade.

An increase in local air pollution would further harm public health, leading to thousands of extra premature American deaths over the next decade, according to Energy Innovation’s analysis.

To summarize, while repealing the IRA would save the government around $500 billion over the next decade, it would also cost:

- $1 trillion in economic growth and around $2,000 per American household in higher energy costs

- Hundreds of thousands of lost domestic manufacturing and construction jobs

- Reduced energy security and a higher risk of blackouts

- 3 billion tons of climate pollution and thousands of American lives

That’s a bad deal! Use our updated action tool to send a message to your Senators now to urge them to preserve these valuable tax credits.