By Katie Zakrzewski

In 2021, the European Union announced its plan to implement a carbon border adjustment mechanism (CBAM) in 2023. You might be wondering what exactly is a CBAM, and what does it mean for climate provisions?

What is a CBAM?

The fastest way to drive down carbon emissions is to target the highest-polluting sources. Countries like the United States that have invested in cleaner, more efficient innovations for these products should not be at a competitive disadvantage with those that have not. One way to level the playing field is to place a carbon border adjustment mechanism (CBAM) on goods from countries whose products have a higher carbon footprint. A CBAM could account for differences in the higher carbon goods from countries with higher emissions per ton of product and reward the most efficient producers while providing an economic incentive for other nations and industries to take steps to cut their emissions.

A CBAM, then, provides the economic incentive and leverage needed to invest in clean energy, and to encourage other countries to do the same. To protect U.S. manufacturers and jobs, carbon-emitting fuels and carbon-intensive goods from countries that do not have a carbon emissions reduction program analogous to ours will pay a border carbon adjustment. Conversely, producers of fuels and carbon-intensive goods exported from the United States to countries that do not have a carbon emissions program will receive a rebate for the carbon fees that were levied under the act. Note that these fees are not levied directly on producers of carbon-intensive goods, but due to fees on fuels consumed, their production costs are higher.

This border adjustment prevents a U.S. carbon fee from putting American businesses at a competitive disadvantage in global markets. It will also remove the incentive for them to relocate overseas to avoid the carbon fee. In addition, it will encourage foreign countries to adopt their own carbon fee so they would get the money instead of us.

CBAMs appeal to Republicans

This means that CBAMs can be used as a financial lever in international trade with Russia and China, among other countries, and are a popular concept with Republican offices:

“If we had a border carbon adjustment, it would help our workers, help our industry, incentivize them to do it right.”

“We have an opportunity to counter Putin’s playbook with a bold initiative consistent with European priorities: a transatlantic climate and trade initiative that would cut global greenhouse gas emissions, increase energy security, and reduce Russia’s power to coerce Europe.”

Not only does the CBAM appeal to Republican offices because of its economic fairness and feasibility, but the CBAM can also be adjusted to target different goals or scenarios, such as reducing the carbon footprint of a product, working in conjunction with explicit carbon pricing, or a combination of the two.

It’s important to note that a CBAM is not the same as a tariff. Shuting Pomerleau, a climate policy analyst who specializes in carbon taxes at the Niskanen Center, described the difference between the two in a conversation with CCL Communication Specialist Steve Valk:

“There’s been a widespread misconception that border adjustment equals tariffs, and I think that’s why there has been some proposal saying that maybe we could just enact the carbon border adjustment through executive action like how Trump enacted the tariffs on China. I think what those proposals are actually proposing is an import tariff, not a border adjustment. It’s only an import tax. There’s no export rebate, so you’re not adjusting anything. You’re just putting a tariff on imports. I think the President can enact carbon tariffs if he really wants to, but I don’t think that’s meaningful or good policy. We already have so many tariffs in place. We have trade wars. A lot of domestic manufacturers in the U.S. are calling for lifting the tariffs.”

CBAMs have been implemented internationally

This isn’t just a pie-in-the-sky concept either. Many countries have already started implementing a CBAM.

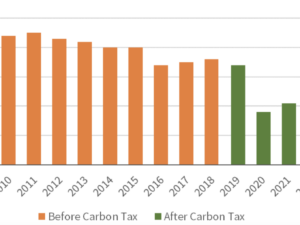

The European Union (EU) is on track to implement their CBAM starting in 2023. Companies will have a reporting requirement in that year for aluminum, fertilizer, electricity, cement, iron, and steel. In 2025 or 2026, countries exporting covered goods to the EU will be required to buy EU carbon certificates — currently around $100 per metric ton of CO2 — to pay for the difference between carbon footprints.

Countries that have a domestic carbon price can also deduct that from the price they would have to pay, incentivizing the U.S. to develop a CBAM as well. If the U.S. were able to match or exceed the EU’s CBAM, they would not face drastic economic repercussions. Canada is considering a similar move.

CBAMs are a unique climate mitigation strategy anchored in economic incentives and aimed at reducing pollution. Discussion is ramping up around meeting the country’s emissions reduction goal by 2050. More and more countries such as India are considering a move toward a carbon mechanism of some sort to mitigate the effects of climate change. The time is ripe for the U.S. to enact a carbon border adjustment mechanism.

Volunteers interested in further information about CBAMs can visit CCL’s self-paced training here.