Why we need a carbon price in reconciliation

By Tony Sirna

Congress has committed to taking action on climate change in this year’s budget reconciliation bill. They should not pass up the chance to go big on climate, include a carbon price, so we can meet the challenge of reducing emissions 50% by 2030 and hitting net-zero emissions by 2050.

There are signals that the legislation will include a wide range of climate provisions — an extension of tax credits for clean energy, a Clean Energy Payment Program, methane pricing, electric vehicle incentives, and even a border carbon fee. But even with these programs there are still many reasons to include a carbon price.

50% by 2030

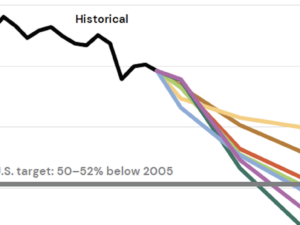

Senate Majority Leader Chuck Schumer recently sent a letter to his Senate colleagues highlighting the importance of this legislation in meeting the 50% by 2030 commitment that President Biden made to the world. Unfortunately the chart he included showed how the current outline of the legislation only gets us to 45% reductions. While a robust carbon price could hit 50% on it’s own, even adding a small carbon price to the bill, as low as $20/ton, could easily push us from 45 to 50% reductions.

Simple and quick

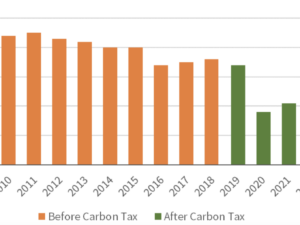

As the latest IPCC report shows, we need to reduce emissions and we need to start now and move quickly toward zero emissions. One of the best features of a carbon price is that it can be implemented simply and quickly — Canada started collecting their carbon fee within 6 months of passage — and it can have immediate effects on emissions, in some cases even before the price goes into effect. And the sooner you reduce emissions, the greater the cumulative effect, which is what matters most to the climate.

Regulations can sometimes take years to get finalized, or to fend off challenges in court, and even investments and tax credits can take time to show their effects. A carbon price can start reducing emissions now, while regulations move through those processes, and can provide a backup in case regulations are struck down by the courts.

Reduces emissions across the whole economy

In addition, a carbon price would not be limited to the electricity sector or to personal vehicles, but would reach all sectors of the economy. Right now the industrial sector, including things like steel, cement, chemicals, and other manufacturing, represents 23% of US emissions. Without a carbon price, the reconciliation bill might have minimal impact on these emissions.

Complements other climate solutions

A carbon price would also support almost any other program in the reconciliation bill, by further aligning economic incentives with any regulations and investments. For example, if there are programs to help people electrify their homes and make them more efficient, a carbon price will make it even more clear to consumers that such a step is worth the investment and will save them money on heating bills.

A carbon price can also act as a backstop in case certain provisions of the legislation are deemed inadmissible for reconciliation by the Senate parliamentarian. For instance, in the Clean Electricity Payment Program, the parliamentarian might rule against penalties for utilities not meeting targets. This could hobble that program, leaving it without any mechanism to drive compliance with utilities not motivated by the potential for payments. A carbon tax could provide that incentive and experts say it is almost certainly acceptable in budget reconciliation.

Makes a border fee possible

A domestic carbon price may also be essential to implementing a border carbon fee. Europe and Canada are already planning to have such fees, but it’s unclear that the U.S. could do the same without a domestic price, and still be compliant with the World Trade Organization standards. A domestic price would harmonize our climate policies with Europe and Canada (some of our biggest trading partners) and allow us to implement border fees with other countries without a comparable price. This could be key to getting nations like China to take faster action to reduce their emissions.

Will not increase overall costs

And finally one other big feature of a carbon price is that, unlike most other climate provisions in the reconciliation bill, it does not add to the cost of the package and will not increase the deficit or debt. Instead a carbon price would make polluters pay. Since it is not in competition with other provisions for budget expenditures, it would be easy to add in on top of any other provisions. And if revenue from the price is returned to households it would not raise overall costs for low and middle income households, which aligns with the President’s priorities for not raising taxes.

Carbon pricing has the support of 70% of Americans and business leaders from across the economy. It is good policy that will reduce emissions fast, put money in people’s pockets, save lives by reducing pollution, and can work well with the whole array of climate policies expected in reconciliation. Congress should not miss this opportunity to go big on climate with a strong carbon price in reconciliation.