By Jonathan Marshall

April 2019

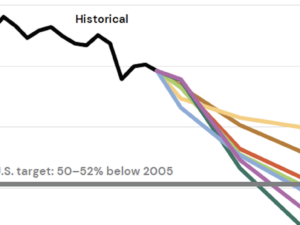

Summary: Taxes on fossil fuels will not achieve miracles if they are capped too low or restricted to a few industries. However, the well-studied experiences of the U.K., British Columbia, and Sweden prove that carbon taxes worldwide not only can, but do, have powerful impacts on greenhouse gas emissions when set reasonably high and given broad coverage. With its steadily rising fee levels and application to virtually the entire economy, the Energy Innovation and Carbon Dividend Act should slash U.S. greenhouse gas emissions even more dramatically than these examples, justifying political action to make it a centerpiece of national climate policy.

More than 3,500 economists, including more than two dozen Nobel laureates, have signed a statement calling for “immediate national action” to address global climate change and declaring that “a carbon tax offers the most cost-effective lever to reduce carbon emissions at the scale and speed that is necessary.” The formula they propose—a “robust and gradually rising carbon tax” to harness the “invisible hand of the marketplace to steer economic actors towards a low-carbon future,” combined with equal lump-sum rebates of the revenue to every individual—is embodied in H. R. 763, the Energy Innovation and Carbon Dividend Act. It would levy an initial tax of $15 per ton of carbon dioxide on fossil fuel providers, rising every year by $10 a ton until emissions have been reduced 90 percent below 2016 levels. It would also tax emissions of other greenhouse gases commonly used as refrigerants.

How can economists and other experts be so confident in the ability of such taxes to slash greenhouse gas emissions? The answer, in a word, is experience.

The first kind of experience relates to the observed way that people for thousands of years have reacted to changes in prices. Simply put, purchases of most goods, most of the time, fall when their prices go up relative to possible substitutes. In market economies, producers adjust to follow (or even anticipate) such shifts in consumption. Based on millions of historical data points in hundreds of industries, economists have built models to predict how quantities of goods and services will react to policy changes. The best current economic models all agree that raising taxes on fossil fuels, while returning revenues to individuals by various means, will powerfully cut consumption of these climate-disrupting sources of energy. For example, a fee of $50 per ton of CO2, rising at 5% per year, could slash greenhouse gas emissions more than 40% below 2005 levels by 2030, according to the Stanford Energy Modeling Forum. (1) The bipartisan Energy Innovation and Carbon Dividend Act, with its lower starting point ($15/ton) but steeper ramp ($10/year), would likely slash emissions at least as much. (2)

Real-world experience with carbon taxes

If you don’t trust the models, consider the second kind of experience: the actual trajectory of emissions in several jurisdictions that have imposed carbon taxes. The examples discussed here represent some of the few jurisdictions that have levied relatively high tax levels on fossil fuels, covering major sectors of their economies, for a period of at least several years. (3)

-

United Kingdom

In 2001, the UK imposed a Climate Change Levy on fossil fuel use by some manufacturing plants, ranging from £16 to £30 per ton of carbon. Affected plants cut their electricity use by an average of 23 percent. (4)

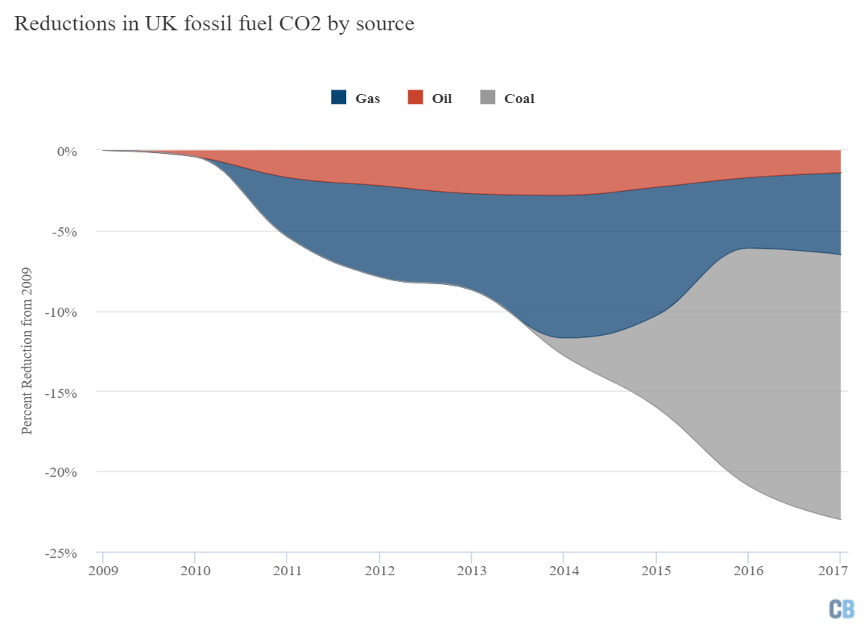

In 2013, the UK introduced a broader Carbon Price Floor on fossil fuels at a rate of about $23/ton of carbon dioxide-equivalent (tCO2e). Although it covers only 23 percent of emissions, by 2017 the UK’s total CO2 emissions were 38 percent below 1990 levels and as low as emissions were back in 1890. (5)

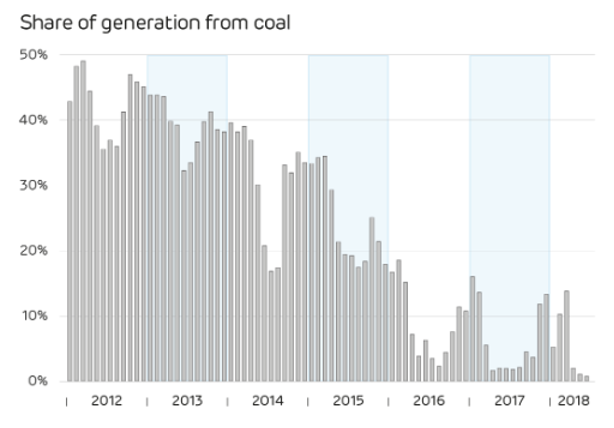

- Electricity generation from coal fell by four-fifths from 2012, before the tax was imposed, to 2016. (6) See graph below.

- A 2018 report by academics at Imperial College London and consultants from E4tech, declared, “The UK’s carbon price . . . has led to rapid deployment of renewables and the fastest phase out of coal power, making for world-leading progress in reducing the carbon emissions from power generation. . . Uptake of electric vehicles is also among the highest in the UK, which is home to the world’s 5thlargest electric vehicle fleet.” (7)

Source: https://www.carbonbrief.org/analysis-uk-carbon-emissions-in-2017-fell-to-levels-last-seen-in-1890

Source: Electric Insights Quarterly – Q2 2018

-

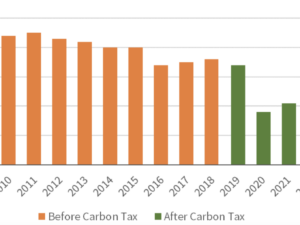

British Columbia

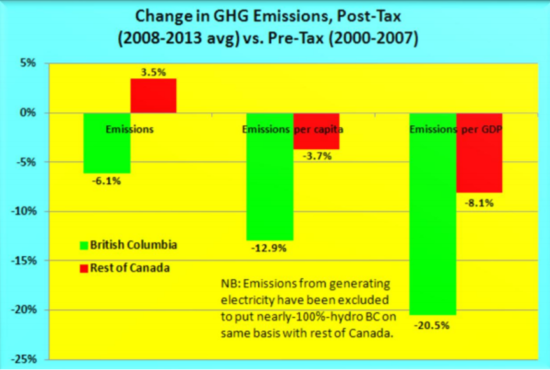

The Canadian province of British Columbia introduced a tax on most fossil fuels, starting at C$10/ton/CO2 in 2008, and rising to C$30 in 2012, where it remained until increasing again to C$35 in 2018. Demand for petroleum fuels and commercial natural gas fell significantly. From 2008 to 2013, per capita CO2 emissions declined as much as 15 percent, with no demonstrable reduction in the province’s economic performance. (8)

Source: Charles Komanoff, “British Columbia’s Carbon Tax: By the Numbers” December 17, 2015

-

Sweden

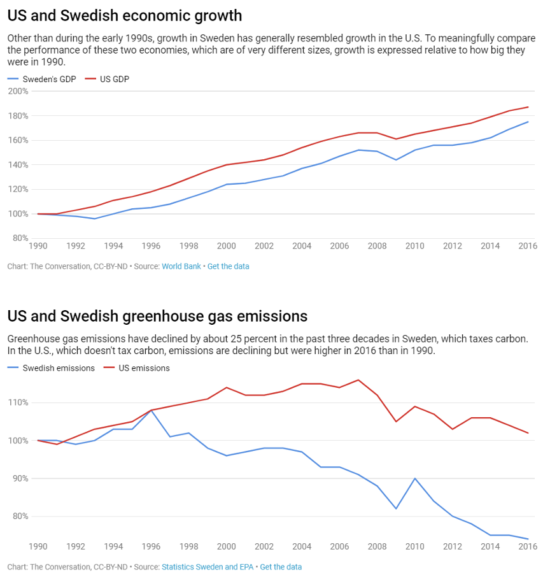

Sweden introduced a carbon tax in 1991, rising from €29 per ton over time to €137 per ton, the highest rate in the world. Even though the tax covers less than two-thirds of CO2 emissions sources, it has had a tremendous impact. (9) In 2016, Swedish Minister of Finance Magdalena Andersson, said “We’ve had GDP growth of 60 percent, and at the same time, our emissions have been reduced by 25 percent. So, it shows that absolute decoupling is possible.” (10)

Most remarkably, to confirm her point, Sweden now emits only a quarter as much CO2 per dollar of GDP as the United States. (11) Its per capita GHG emissions are also about a third lower than the European Union average. (12)

Source: https://theconversation.com/with-the-right-guiding-principles-carbon-taxes-can-work-109328

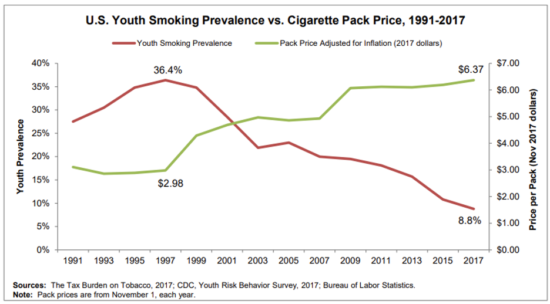

Experience with other taxes on behavior

Getting people to break their “addiction” to fossil fuels will be no easy task, whatever the policy tools, but consider the success of tobacco taxes in cutting smoking in the face of real substance addiction. The National Cancer Institute and World Health Organization concluded in 2016: “A substantial body of research, which has accumulated over many decades and from many countries, shows that significantly increasing the excise tax and price of tobacco products is the single most consistently effective tool for reducing tobacco use. Significant increases in tobacco taxes and prices reduce tobacco use by leading some current users to quit, preventing potential users from initiating use, and reducing consumption among current users.” (13)

https://www.tobaccofreekids.org/assets/factsheets/0146.pdf

Conclusion

The well-studied experiences of the U.K., British Columbia, and Sweden prove that carbon taxes not only can but do have powerful impacts on greenhouse gas emissions when set reasonably high and applied broadly across sectors of the economy. With its steadily rising fee levels and coverage of virtually the entire economy, the Energy Innovation and Carbon Dividend Act should slash U.S. greenhouse gas emissions even more dramatically than these examples, justifying political action to make it a centerpiece of national climate policy.

Jonathan Marshall is former Economics Editor of the San Francisco Chronicle. He has written on carbon pricing for the New York Times, Reason magazine, Huffington Post, and other publications.

Footnotes:

1. Alexander Barron, et al., “Policy Insights from the EMF 32 Study on U.S. Carbon Tax Scenarios,” Climate Change Economics, Vol. 9, No. 1 (2018); Jonathan Marshall and Robert Archer, “10 fast facts about revenue-neutral carbon fees,” CCL Economics Policy Network (2018).

2. Noah Kaufman, “How the Bipartisan Energy Innovation and Carbon Dividend Act Compares to Other Carbon Tax Proposals,” November 27, 2018.

3. As Tufts University economist Gilbert Metcalf recently observed, “The literature on the economic impacts of a carbon tax are somewhat thin, in part since few broad‐based carbon taxes have been in place for a long enough time to assess.” (“On the Economics of a Carbon Tax,” February 24, 2019, prepared for Brookings Papers on Economic Activity Meeting, March 7-8, 2019.) For rundowns of the literature, see Goksin Bavbek, “Carbon Taxation Policy Case Studies,” Centre for Economics and Foreign Policy Studies, October 2016; Steven Nadel, “Learning from 19 Carbon Taxes: What Does the Evidence Show?” American Council for an Energy-Efficient Economy,” 2016; and Zheng Li and Junjing Zhao, “Environmental Effects of Carbon Taxes: A Review and Case Study,” World Journal of Social Science 4:2 (2017), 7-11.

4. Ralf Martin, et al., “The impact of a carbon tax on manufacturing: Evidence from microdata,” Journal of Public Economics 117 (September 2014), 1-14.

5. Zeke Hausfather, “Analysis: UK carbon emissions in 2017 fell to levels last seen in 1890,” March 7, 2018.

6. Akshat Rathi, “A Carbon Tax Killed Coal in the UK,” Quartz.com, February 1, 2018.

7. “Energy Revolution: A Global Outlook,” December 2018; quote from press release, December 5, 2018.

8. Brian C. Murray and Nicholas Rivers “British Columbia Revenue Neutral Carbon Tax: A Review of the Latest ‘Grand Experiment’ in Environmental Policy,” Duke University, Nicholas Institute, Working Paper NI WP 15-04, May 2015; see also Charles Komanoff Charles and Matthew Gordon, “British Columbia Carbon Tax: By the Numbers,” December 2015 and Robert Archer, “British Columbia Revenue Neutral Carbon Tax: Lessons Learned for the U.S. and Beyond,” Citizens’ Climate Lobby, October 2018.

9. Swedish Federal Ministry for the Environment, Nature Conservation and Nuclear Safety, “The Carbon Tax in Sweden,” September 3, 2018. Sweden’s electricity sector, and two-thirds of its industrial sector (which accounts for 62 percent of all energy-related emissions) are covered not by the country’s carbon tax but by the European Union’s Emissions Trading System. Until 2018, carbon prices under the ETS typically fell below €10 per ton. Other important factors to note when assessing the impact of Sweden’s carbon tax:

- The impact of Sweden’s carbon tax on transportation emissions was muted by the fact that Sweden already had very high fuel taxes of about 5.5 SEK/liter before 1991. Today the carbon tax amounts to about 7 SEK/liter, an increase of only 30 percent. (Julius J. Andersson, “Cars, Carbon Taxes and CO2 Emissions,” March 2017, London School of Economics and Political Science, Figure 1.)

- In 1990, Sweden generated almost all of its electricity from hydro and nuclear power, so there was essentially no room for improvement in CO2 emissions. In the United States, by contrast, coal and natural gas account for more than 60 percent of electricity production.

10. Quoted in World Bank Group, “When It Comes to Emissions, Sweden Has Its Cake and Eats It Too,” May 16, 2016, http://www.worldbank.org/en/news/feature/2016/05/16/when-it-comes-to-emissions-sweden-has-its-cake-and-eats-it-too. See also Swedish Federal Ministry for the Environment, “The Carbon Tax in Sweden,” September 3, 2018; Julius J. Andersson, “Cars, Carbon Taxes and CO2 Emissions,” March 2017, London School of Economics and Political Science.

11. Sweden emits 0.08 kg versus 0.32 kg per $US. World Bank, “CO2 emissions (kg per 2010 US$ of GDP).” Sweden also emits only about as quarter as much CO2 per capita (World Bank, “CO2 emissions per capita – metric tons”).

12. “The Carbon Tax in Sweden,” 3-4.

13. NCI and WHO, The Economics of Tobacco and Tobacco Control, 2016, 10-11.