10 fast facts about revenue-neutral carbon fees

By Jonathan Marshall and Robert Archer, CCL Economics Policy Network

The most sophisticated economic models available today tell a consistent story about the likely impacts of levying a national fee on fossil fuels: By changing the daily behavior of every consumer, investor, and enterprise, such fees would dramatically reduce emissions of carbon dioxide (CO2), the single largest man-made greenhouse gas, as well as conventional air pollutants that cause major health problems.

The other good news is that these benefits would come with almost no impact on economic growth. Furthermore, returning revenues to the general population through rebates (“dividends”) would ensure that such fees remain affordable to people of all incomes, while still changing their behavior. Indeed, a 2017 Treasury Department analysis found that roughly two-thirds of households would see their incomes grow from carbon dividends, while the remaining wealthy households could easily handle the higher cost.

Although many economists have studied carbon fees, the most extensive exercise was performed in 2017 by the Stanford Energy Modeling Forum (EMF), which analyzed the impacts of several relevant pricing scenarios under 11 models of varying design. Based on an independent, peer-reviewed summary of the EMF exercise,* we can confidently draw these first five conclusions:

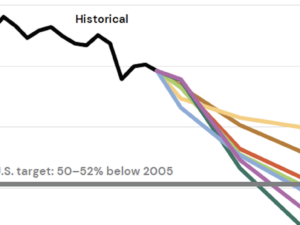

- Carbon fees will significantly lower greenhouse gas emissions. “All of the carbon pricing policy scenarios significantly lower emissions compared with the reference scenario; the larger the carbon price, the deeper the emissions reductions. A carbon price of $25 in 2020 that rises at 1% per year reduces CO2 emissions roughly 16–28% below 2005 CO2 emissions levels by 2020 and 17–38% below 2005 levels by 2030. A carbon price of $50 in 2020 rising at 5% per year reduces emissions 21–35% below 2005 levels by 2020 and 26–47% below 2005 levels by 2030.”

- Carbon fees will incent R&D investments in new technology breakthroughs to help curb climate change even faster and at lower cost than these models predict. “Important changes [not addressed by the models] can include new technologies, such as new kinds of energy storage, or societal or cost shifts that significantly alter how actors can lower emissions. . . The introductions of new technology or shifts in behavior could mean that, in practice, lower carbon prices achieve the needed reductions.”

- By curbing fossil fuel use, carbon fees promote other valuable health benefits, including lower emissions of deadly air particulates, nitrogen oxides, and sulfur dioxide. “The resulting health benefits can be significant on a macroeconomic scale, and the reductions occur rapidly in the first decade of the policy—accruing benefits to current generations. . . . Projected health effects for the average reduction in SO2 and NOx in 2025 from a $25 carbon tax are on the order of 3,500–8,000 avoided cases of premature mortality and 90,000 cases of exacerbated asthma. This corresponds roughly to a monetized value of $31–71 billion in health benefits . . . These estimates . . . do not include other harder-to-quantify and monetize health benefits or economic benefits such as increased labor productivity/participation. Emissions reductions from other sectors or other pollutants would further increase health benefits.”

- The economy will continue to grow just fine with a carbon fee. “Annual GDP growth continues and the reduction in the level of GDP in future years relative to a business as usual case is projected to be below 1% even under substantial carbon tax levels. . . In the reference scenario (with no carbon tax or climate impacts), the U.S. economy reaches $25 trillion roughly in year 2034; under the carbon tax, the economy would reach the same level in the following year.” Note that, as discussed in a recent CCL blog post, the authors of the EMF policy summary state that the GDP estimates reflect more of a worst case scenario than a likely one, and we are still comfortable with REMI estimates that show GDP rising.

- How the fee revenue is returned to households has negligible impact on economic growth, but a big impact on equity. “The differences in GDP outcomes across recycling options vary across models and are generally small. . . Across all models, [individual or household] rebate scenarios provide more relative benefit to lower income households than higher income households. . . . Critically, emissions outcomes do not depend upon the use of the revenue to reduce existing taxes. . . This is good news, as it gives policymakers freedom to address other policy concerns (such as impacts on low-income households . . .) without sacrificing environmental benefits.”

Note: The models summarized here compared four basic scenarios, starting in 2020: a tax of either $25 or $50 per ton of CO2, rising at either 1 percent or 5 percent per year. (Such a tax on fossil fuels would cover about 77 percent of all U.S. greenhouse gas emissions.) The scenarios were all revenue neutral, meaning the revenues were to be returned either through a household rebate, or reductions in corporate or payroll taxes. The Citizens’ Climate Lobby proposes charging an initial fee of $15, rising at $10 per year, with all revenue rebated to individuals.

In addition to the EMF exercise, many other economists are finding carbon fees to be positive and politically viable, too.

- Carbon fees support cost-saving innovation. Dr. Joseph Kennedy, former chief economist for the U.S. Department of Commerce, declared in a 2018 paper, “Raising the cost of carbon-intensive activity will give firms stronger incentives to develop more carbon-efficient technologies. Because they will be cheaper than existing technologies, these carbon-efficient technologies should ultimately be more widely adopted, thereby reducing the cost of achieving a given amount of emission reductions. Over the last two decades, a growing body of research has focused on the nature and size of this ‘induced innovation.’ This research shows that a carbon tax would lead to more investment in clean technology innovation beyond what would otherwise occur. And this induced innovation would lower the cost of achieving a given level of emission reductions.”

- Carbon fees have political support. A 2018 public opinion survey by the Yale Program on Climate Change Communications finds that 71 percent of all registered voters, including 56 percent of Republicans, favor requiring fossil fuel companies to pay carbon taxes.

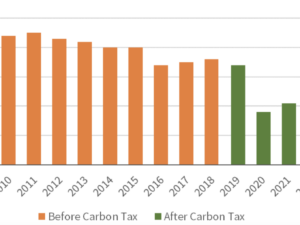

- Carbon fees are gaining political momentum. According to a 2018 paper by World Bank senior research economist Govinda R. Timilsina, “Although carbon tax has been in practice for over the last 28 years in some countries . . . it is gaining international attention more recently, particularly after the 2015 Paris Accord. Politicians who were reluctant to consider carbon tax due to potential resistance from the consumers or adverse implications to their voter base, started to take the challenge of discussing carbon tax and ultimately introducing it. The large pool of knowledge on various issues of carbon taxation and effective communication to policy makers of the fact that carbon tax is the most efficient policy instrument to mitigate climate change might have contributed to gradually increasing political acceptability to carbon tax. . . At the international level, more than 80 countries of the total 155 countries who are signatories to the Paris Agreement are considering using carbon pricing as a tool to meet their climate change mitigation goals.”

- Carbon fee-and-dividend proposals are politically sustainable. Several prominent economists, led by former World Bank chief economist Nicholas Stern, argue in the prestigious journal Nature Climate Change (2018) that “lump-sum dividends” are likely to be “more stable over time [than green spending or tax cuts] particularly in countries bogged down with issues of economic inequality, political distrust, and polarization. . . . The ideal recycling of carbon pricing revenue strongly depends on the political context. . . Uniform lump-sum recycling is favourable in more general circumstances since it may ensure broad public support.”

- Lump-sum rebates are more efficient than green subsidies. According to a 2018 paper by World Bank senior research economist Govinda R Timilsina, “using carbon tax revenue to subsidize clean technologies, such as solar and wind power for electricity generation, efficiency improvements of energy utilizing technologies, does not lower the economic costs of carbon tax. Instead it would increase the costs as recycling the revenue from one distortionary policy (i.e., carbon tax) to finance another distortionary policy (i.e., clean technology subsidy), exacerbating the economic distortions.” However, well-defined government policies to overcome existing market failures, such as promotion of clean-energy research or programs to reduce emissions of greenhouse gases from other sources, can complement carbon-fee policies to enhance national and global responses to climate disruption.

*Source: Alexander Barron, et al., “POLICY INSIGHTS FROM THE EMF 32 STUDY ON U.S.

CARBON TAX SCENARIOS,” Climate Change Economics, Vol. 9, No. 1 (2018)

Jonathan Marshall has published articles about carbon taxes in the New York Times, Reason magazine, HuffingtonPost.com, and San Francisco Chronicle, where he was Economics Editor. He is a member of the Marin California chapter of CCL.

Before his retirement, Robert Archer served as Senior Energy Advisor for the U.S. Agency for International Development. He is a member of the CCL Marin California Steering Committee and the CCL Economics Policy Network.