Rep. Van Hollen introduces cap-and-dividend bill

At the end of July, Rep. Chris Van Hollen (D-MD) has introduced a cap-and-dividend bill, The Healthy Climate and Family Act. Here is CCL’s position on this legislation:

There’s a lot to love about the Van Hollen bill. We are very encouraged to see the 100% dividend to households as a central component of the plan. The bill specifies that all carbon permits are auctioned, and permits are assigned upstream, making the plan more cost-effective and a more direct market signal. Like CCL’s proposal, the Van Hollen bill also includes border adjustment tariffs to prevent off-shoring of carbon and maintain a level-playing field for American businesses. Unlike previous carbon-pricing bills, Van Hollen’s bill excludes the use of carbon offsets to comply with the cap, closing an all-too-convenient loophole for polluters.

The introduction of this legislation shows that we have moved legislators — especially Democrats — a long way toward revenue-neutrality in carbon pricing, as well the concept of returning revenue to households as dividends. This is an important step forward as we seek bi-partisan legislation, and we’re thrilled with Van Hollen’s bill from that standpoint.

The important difference between this bill and CCL’s proposal is the mechanism to achieve emissions reductions — a declining cap vs. an escalating fee. CCL believes the fee’s simplicity and transparency make it a more efficient approach to achieving reductions. Our approach has already garnered support from conservatives, improving the likelihood of gaining the Republican support necessary for legislation to pass in Congress.

The Van Hollen bill is a great start, and with some changes to the front end, we’ll have legislation that can attract the bipartisan support needed for passage.

Border Adjustment a Big Concern for Congress:

In our cursory review of all the meeting notes taken on our lobby day, we noticed that a concern for many Members of Congress is the effect and legality of our proposed border adjustment as well as the behavior of other heavy emission nations such as China. Thankfully we have prepared laser talks on the border adjustment, two talks about China (also here), and a new talk explaining that countries responsible for nearly 50% of global carbon emissions already have a carbon price mechanism planned or in place.

State Carbon Taxes as Compliance with EPA rule

Recently the EPA has released draft rules aimed at reducing emissions from power sources to 30% below 2005 levels. Once the rules go into effect after the notice and comment period, states must submit to the EPA a plan to comply with them under CAA 111(d), lest the EPA impose a plan for compliance on them. Nowhere in the proposed rules does it explicitly mention that a State could comply by implementing a carbon tax on regulated sources, making it unlikely that a State would take the risk of going that route. CCL will be taking action on this as one of our August actions.

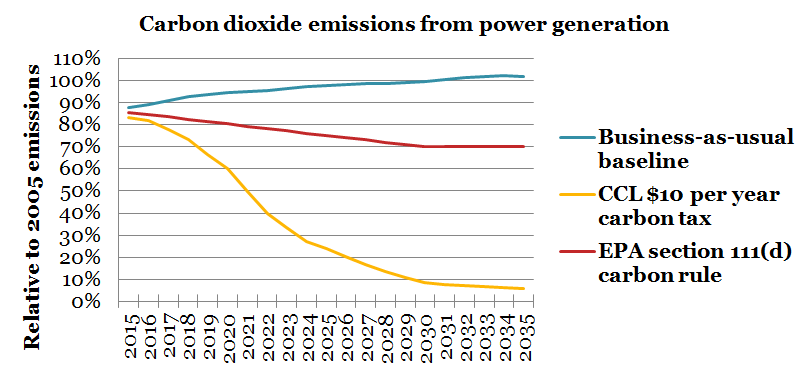

If you’re curious about how CCL’s Carbon Fee and Dividend plan stacks up against the regulatory targets established by the EPA, the REMI report author Scott Nystrom put together the chart above. As you can see, the nation’s power sector would reach the EPA 2030 targets by 2019, and by 2030 would actually have reduced power sector emissions to less than 10% of their 2005 levels; more than a 90% reduction! Thanks to Scott for the figure.

Rep. Delaney’s (D-MD) State Choice Act

Staying on the theme of the EPA regulations, Rep. Delaney from Maryland’s 6th District is in the process of introducing a bill that would allow states to implement a carbon tax on regulated sources as a way to comply with the proposed EPA regulations under CAA 111(d). The press release from Rep. Delaney is here (The text of the draft bill is here).

Senators Collins (R-ME) and Murphy (D-CT) to Introduce Bill limiting Short-Lived Climate Pollutants (SLCP)

SLCPs, sometimes referred to as “super pollutants” are non-CO2 greenhouse gases that cause 40% of global warming. These include methane from landfills and oil/gas exploration, refrigerants leaking from refrigerators and air conditioners, and soot from diesel engines and the millions of cook-stoves in the developing world. The Senators’ bill aims to reduce these pollutants with steps such as mitigating methane leaks, recycling high-global warming potential (GWP) refrigerants, and expand access to diesel-scrubbing technologies. The press release from Sen. Collins is here (The text of the draft bill can be downloaded here).

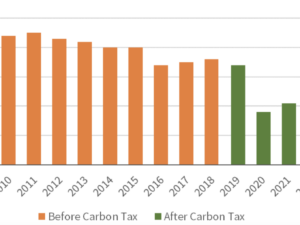

Australia Repeals its Carbon Tax

As you may have heard, Australia recently repealed its carbon tax just two years after it was implemented. Their carbon tax can’t be said to be a failure, with carbon emissions from power generation undergoing a noticeable drop and an increase in the generation of renewables. The tax was not revenue neutral, however, as some of the money went back to the very companies it was supposed to tax. You can take a look at our laser talk on why it was repealed here. Mark also got a great op-ed published here, which explains some of the political history at work.

Arcane Rule of the House: No Nods to the Peanut Gallery

In the interests of furthering all our knowledge about how Congress works, here’s your arcane or obscure rule for the month: “During a session of the House, it shall not be in order for a Member, Delegate, or Resident Commissioner to introduce to or to bring to the attention of the House an occupant in the galleries of the House. The Speaker may not entertain a request for the suspension of this rule by unanimous consent or otherwise.” –Rule XVII(7) of the House of Representatives.