New studies: Carbon taxes yield strong economy, good jobs

By Jerry Hinkle

Two analyses were recently published that indicate the impact of a carbon tax policy, like the Energy Innovation and Carbon Dividend Act, on the quality and quantity of U.S. jobs. The results are both encouraging and useful for CCL’s climate advocacy.

Big benefits at zero economic cost

The first study comes from economists at Harvard and Tufts Universities, and is published in the U.S.’s top economic journal. It utilizes a new dataset from the World Bank that shows the impact actual carbon pricing policies have had on jobs and GDP in 31 European countries over the last three decades.

This study is unique and important for two reasons. First, the prior analyses we have relied on, from Columbia, RFF and others, modeled the impact of a carbon tax with the use of significant assumptions that allow them to forecast the economy forward in policy (i.e., with the carbon tax) and no-policy scenarios to discern what impact the policy would have. The new study does not require these assumptions: it looks back over the last 30 years at the policies that have been in place to ascertain their actual impact (vs. projected) on jobs and GDP. Second, the prior analyses could not accurately forecast the impact on jobs, so did not provide such estimates, but this new study is able to estimate what the actual impact on jobs was for the 31 countries over the 30-year period.

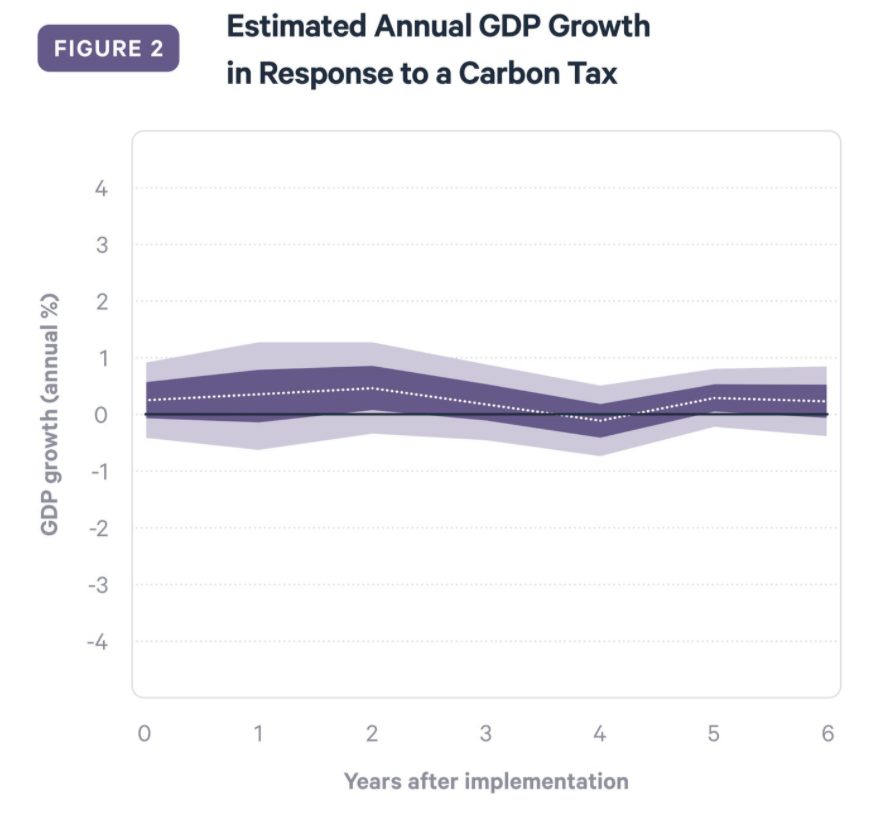

The study’s results pertaining to the impact on GDP (see chart, below) are a bit more positive than that from the prior analyses. The carbon tax policies already in effect had a slight positive impact on GDP growth, whereas the prior analyses forecasted a neutral to slightly negative impact. This result is consistent with the summary statement provided by economist Noah Kaufman to Congress last year when he stated studies suggest carbon tax policies have “roughly zero impacts on the overall growth of the U.S. economy.” Remember, these models do not include the value of the climate and health benefits from the policy.

In other words, 30 years of evidence from a carbon tax in Europe confirms what model forecasts have indicated: enormous climate and health benefits would accrue to the U.S. from a policy like the Energy Innovation Act and Carbon Dividend Act, and those benefits would come at roughly zero cost to the economy. Given these benefits are valued at over $800 billion per year (Footnote 1), our policy would clearly be of tremendous net benefit to the country.

A typical impulse response function for the impact on the annual rate of growth of GDP in response to a permanent $40 increase in a carbon tax, estimated using a structural vector autoregression. The white dotted line indicates the point estimate, and the two shaded areas indicate 67 percent and 95 percent confidence bands. From Metcalf and Stock, 2020, RFF.

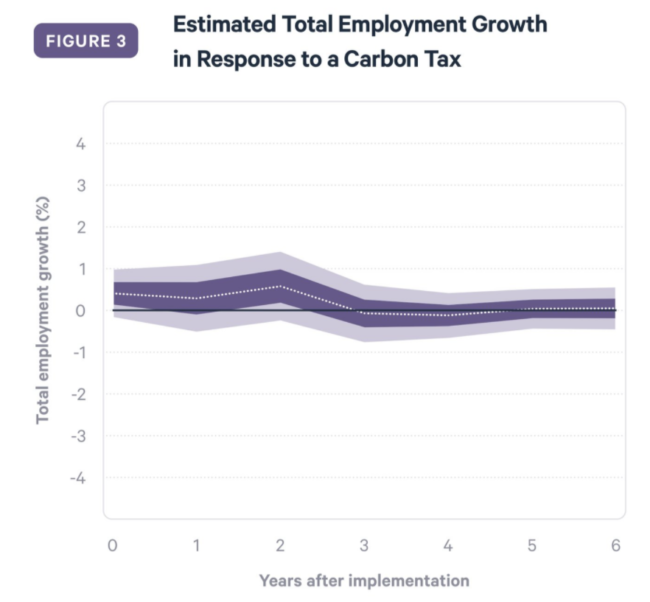

The results on jobs (see chart, below) are positive as well. The European carbon tax policies caused employment to shift away from industries that pollute more, and toward the emerging clean energy economy. Initially, more jobs are created than lost, though this net job growth fades over time. (Results should be stronger under a policy where all funds are returned to households.)

This experience with job growth is consistent with (see page 7) results from British Columbia’s carbon tax. These results are important for our advocacy because actual experience in Europe over 30 years makes clear that carbon tax policies in practice have been positive for jobs. The evidence is clear that these policies are not “job killers.”

A typical impulse response function for impact on the annual rate of growth of employment in response to a permanent $40 increase in a carbon tax, estimated using a structural vector autoregression. The white dotted line indicates the point estimate, and the two shaded areas indicate 67 percent and 95 percent confidence bands. From Metcalf and Stock, 2020, RFF.

A boost to clean energy jobs

The second study evaluates the quality of clean energy jobs (2) in the U.S. by comparing the wages and benefits of these jobs—clean energy generation, energy efficiency, clean grid and storage, clean fuels, and clean vehicles—to the national average as well as to those in the fossil fuel industry. The summary results are as follows:

- Median hourly wages for clean energy jobs are 25% higher than the national median wage. Further, clean energy jobs are more likely to come with health and retirement benefits than the rest of the private sector. And generally, unionization rates for clean energy jobs are slightly higher than the rest of the private sector.

- Clean energy job salaries are comparable to fossil fuel job salaries. For instance, jobs in coal, natural gas and petroleum fuels pay about $24.37 an hour, while jobs in solar and wind pay about $24.85 an hour. Similarly, jobs in energy efficiency come with median salaries of about $24.44.

- Even without a charge for pollution, U.S. clean energy employment has grown 6.0%, more than twice the national average, for the last three years (2017-2019). In contrast, employment has fallen in the natural gas (-5.3%) and coal (-7.1%) businesses.

This information is important for our advocacy because the creation of good quality jobs is of critical importance to our country, especially now. Economic analysis makes clear that a carbon tax will shift jobs to the clean energy economy, and this analysis provides strong evidence that these new jobs will provide good wages and benefits that are well in excess of the national average and on par with those they are replacing.

The next Congress will present a critical opportunity for climate advocacy. Carbon tax policies will be introduced into Congress, and some opponents of these policies may trumpet that they are “a job killer” or will harm the economy. It’s happened before. At CCL, we are crystal clear that the peer-reviewed literature indicates such policies would have minimal impact on GDP while providing tremendous health and climate benefits, and that the policies will create abundant, high quality jobs.

Footnotes:

- The value of the climate benefits from our policy are being updated in early 2021. The health benefits have been valued at $700 billion a year.

- This excludes nuclear.

Jerry Hinkle is a research coordinator for CCL.