This climate change solution is good for the economy and society

By Jerry Hinkle, CCL Economics Policy Network

Recently, 3500+ economists, including many of the most preeminent in the profession, publicly endorsed one particular climate change solution. They want a gradually rising price on carbon, in which all funds are returned to households. This type of policy is known among economists as one form of a revenue-neutral carbon tax, or RNCT.

Why do economists so widely support charging for pollution and returning all funds? First, they like that correcting market prices by charging for pollution will improve how we allocate our economic resources. Second, a cost/benefit analysis demonstrates that this type of policy is “good for the economy and society.” (This is different than looking at measures of GDP.)

Like most economic issues, it’s not as simple as looking at one projection or focusing on one familiar term, like GDP, to assess a policy. It’s important to consider the full picture. And economists looking at the full picture are confident that a RNCT is an effective way forward.

Better prices, better resource allocation

The sin tax on cigarettes serves as a good example of the value of correcting market prices. Smoking yields substantial costs for treating lung cancer and emphysema that are borne not just by the smoker, but by taxpayers as well via higher Medicare costs. If the market cost of cigarettes paid by the smoker does not reflect these external costs, cigarettes are too cheap, we produce and consume too many, and the economy devotes excessive resources to treating these diseases. In addition, we suffer far more premature deaths. We corrected this by internalizing those external costs with the cigarette tax, and the country now expends far fewer resources on tobacco products and the treatment of related diseases, and we have far fewer premature deaths.

What was the impact on GDP as a result of the policy to tax cigarettes? It would depend on what was done with the funds, but it was likely negligible. Regardless, the economy and society are clearly better off as we devote less resources to treating these diseases, live longer and have better health.

It works the same for fossil fuels: the health and climate costs resulting from their consumption are not reflected in the market price businesses charge. As a result, fossil fuel prices are too low and we have too much carbon pollution. This results in negative health effects and damaging climate change. So we are spending far more on health care and recovering from wildfires, floods, heat waves, droughts, strong storms, sea-level rise, etc. than we should.

If we use a climate change solution like a carbon tax to correct prices, how is GDP impacted? Again, it depends on what is done with the funds, but is minimal (see EMF 32 Overview, page 25). It is often negative because energy costs increase slightly as firms switch to cleaner fuels. However, the models estimating GDP in the peer-reviewed literature only consider the costs of the RNCT policy, and do not reflect the positive economic effects of the improved health or reduced climate damages (Footnote 1) that result, so do not indicate whether the policy is good for the economy (2) or society. Regardless, with a carbon tax, we will ultimately spend less on disaster recovery, and will have better health and fewer premature deaths. Market prices that reflect all costs yield better resource allocation, and we are unquestionably better off for it, and that is why economists support charging for carbon pollution.

Climate policy cost/benefit analysis

If GDP is a poor metric for evaluating policy, what measure would indicate whether a specific climate policy is good for the economy or society? Cost/Benefit Analysis (CBA) is the metric generally used to evaluate the worth of policies. To explore this, the primary benefits and costs of a generic RNCT are described and quantified.

Health co-benefits – Fossil fuel emissions, especially particulate matter (PM2.5), ozone, and sulfur dioxide (SO2), yield significant health impacts in addition to global warming. Duke University’s Dr. Drew Shindell, a leader in this field, estimated these emissions cause 114,000 (3) premature deaths, 180,000 non-fatal heart attacks, 150,000 hospitalizations, 130,000 ER visits for asthma, 18 million lost work days, and 11 million missed school days per year in the U.S. As an indication of the significance of this issue, a 2016 World Bank Report estimated that the cost of air pollution for North America was 2.8% of GDP in 2013.

Shindell later estimated the value of just one health co-benefit of reducing emissions, premature mortality, under a climate policy that constrains the temperature increase to 2°C. He found that the policy would save 295,000 lives by 2030, and 36,000 lives per year afterward. He valued this policy co-benefit at $250 billion per year. Given that the level of emission reductions achieved in this policy is similar to those generated by the Energy Innovation Act (H.R. 763), it is fair to say the value of health co-benefits from the policy is at least $250 billion a year by 2030, though this is clearly a conservative figure as it does not include other health co-benefits of the policy.

Climate benefits: Damages avoided and the social cost of carbon – To estimate the value of emissions reductions caused by climate policy, economists first estimate the value of damages incurred by the economy over time from one ton of carbon pollution, and then discount this to achieve the “present value” (value in today’s dollars) of the emissions. This estimate is termed the social cost of carbon (SCC). The SCC is the ideal level of a carbon tax that, if added to the price of fossil fuels (based on their carbon content), would serve to “correct” the market price by internalizing the external or social costs.

Estimates of the SCC range widely for a number of reasons (see William Nordhaus, The Climate Casino, 2013), but have risen over time as models become more comprehensive in the carbon pollution damages they consider (see discussion here). Two SCC estimates are discussed to provide a range for the metric. An official government estimate of the SCC was produced in 2016 by an intergovernmental working group (IWG) lead by the EPA. Under this, the SCC for 2019 would be roughly $50/ton in today’s dollars. However, this estimate does not include a number of types of damages that are not “readily quantifiable,” (4) and so is considered quite conservative. A recent and more comprehensive SCC estimate published in the journal Nature Climate Change estimated the SCC at $417. So the value of reduced carbon emissions may well be over 8 times the conservative IWG estimates.

Comparing the costs and benefits of a RNCT

In standard economic analysis, the climate and health benefits of the policy discussed above are not included as they are derived from very different estimation processes. As a result, the analysis may indicate a RNCT yields a net economic cost because the carbon price appropriately causes producers and consumers to switch to slightly more expensive (and cleaner) sources of energy, and this would diminish economic activity.

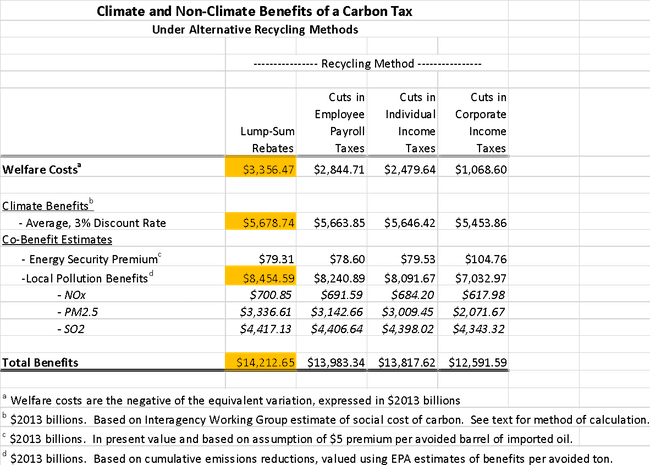

Given that current models do not consider policy benefits, the overall merits of the policy must be assessed by comparing total policy costs with benefits. Below is a representative example of such analysis from Goulder (Stanford) and Hafstead (Resources for the Future) (5). (This model will be used to evaluate the economic impacts of H.R. 763 and other climate legislation.) Here, the GH model evaluated a $20/ton RNCT wherein the revenue is recycled in four different ways. The numbers represent total present values of costs or benefits over time discounted by 3% in $billions. Importantly, for climate benefits, GH uses the very conservative IWG estimates of SCC – we believe climate benefits are much higher.

Regardless, the results make clear that the benefits of a RNCT outweigh the costs by multiples. Specifically, when funds are returned to households, the present value of climate benefits over time of $5.7 trillion and health benefits of $8.4 trillion each greatly outweigh the “welfare costs” (6) of $3.4 trillion. Taken together, the policy benefits of $14.2 trillion are over four times the policy costs of $3.4 trillion! As discussed above, it is important to note that estimates of both health co-benefits and climate benefits are almost certainly quite conservative, so that the ratio of benefits to costs is likely far greater than 4-to-1.

In summary, the economic case for a revenue neutral carbon tax, such as H.R. 763, has never been stronger. First, 3,500 top economists have signed a statement suggesting urgent action on climate change utilizing this very approach. Second, the peer-reviewed economic literature makes clear that policy benefits of this climate change solution are many times more than policy costs, so that such a policy is clearly good for the economy and society.

Footnotes

- They also generally do not reflect savings from regulations that become redundant under the policy, and these can be quite expensive.

- As an example of how changes in GDP do not indicate whether we are better off, if a major flood destroys homes, crops and lives, GDP will reflect the lost crops because they were a product going to market, but not the homes or lives. In fact, when the homes are rebuilt to simply recover from the flood, this production will serve to increase GDP, even though no one is better off as a result of the flooding.

- All of these health costs are from Shindell’s 2014 Congressional Testimony.

- As key examples, the estimates do not include ecosystem damage, loss of species and biodiversity, hurricane intensity, ocean acidification, the potential cost of tipping points or future forced migration and conflicts that may arise as a result of climate change. Further, the models do not reflect the increase damages from extreme weather seen in the last decade.

- See Confronting the Climate Challenge, pg. 117, January 2018.

- Welfare costs represent reduced consumption and reflect economic costs of the policy.

Jerry Hinkle is an economist who holds master’s degrees in Economics and Climate Policy.

The Economics Policy Network is a team of CCL leaders and supporters with a diverse background in the field of economics. These network contributors write regular guest posts, offering thorough insight into topics that fall within their expertise. Their resources are available in the form of white papers on CCL Community.