- April 10, 2024

Driving change: Bill Barron’s journey to spark climate conversations across the Mountain West

April 10, 2024Read moreCCL Mountain West Regional Director Bill Barron spent more than 16 days biking across Colorado, New Mexico, and Montana to talk climate.

- March 8, 2024

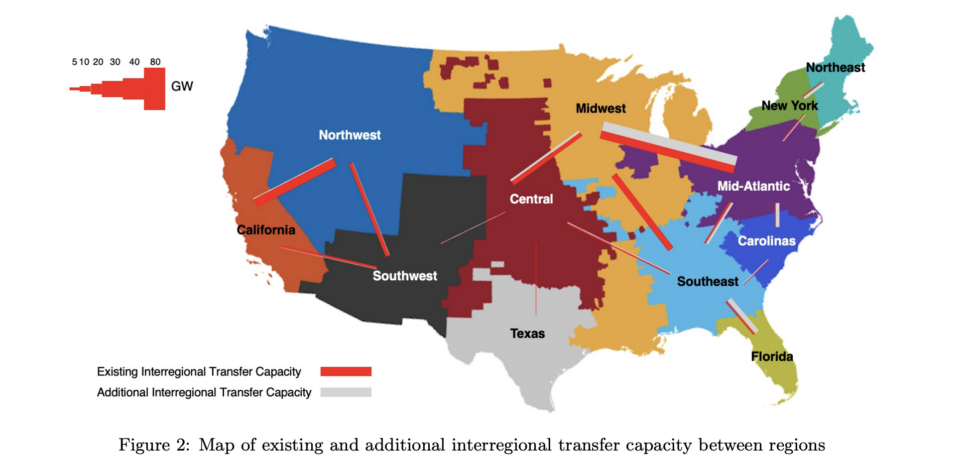

Big impacts from BIG WIRES Act and IRA home rebates

March 8, 2024Read morePer year, the BIG WIRES Act would save the country between $330 million and $2.5 billion and would reduce U.S. emissions about 1–2%.

- March 6, 2024

Washington youth organize state lobby day

March 6, 2024Read moreOn Jan. 15, 2024, CCL Washington youth volunteers held an impressive 21-meeting lobby day at the state’s capitol.

- February 28, 2024

CCL’s Info Session: Find where you fit in

February 28, 2024Read moreThe Informational Session is CCL 101 — it outlines what we care about, what policies we support, and how you can get involved.

- February 27, 2024

A young CCLer’s COP28 story

February 27, 2024Read moreVinay Karthik shares his experience as a Media Logistics Manager for YOUNGO, the official youth constituency of the UNFCCC at COP28.

Spanish

English